Major GST updates Introduced in 2025

Key GST rule updates announced in 2025, Changes affecting small businesses and service providers, Impact on compliance and filings. For businesses, mostly small and medium enterprises (SMEs), understanding these changes is important to avoid misgivings about invoicing software

In 2025, the GST department introduced several important rule updates to enhance transparency and reduce tax leakage. These changes mainly focus on strengthening reporting systems, improving invoice matching, and ensuring timely tax payments. The updates aim to create a more disciplined GST ecosystem while using technology to track transactions more accurately.

1. Mandatory digital invoices for large businesses

From 2025, businesses with an annual turnover above 5 crore are required to generate digital invoices through the GST portal.

Impact on businesses:

- All B2B invoices must be uploaded to the GST portal

- The GST portal generates a unique invoice Reference Number (IRN)

- Each digital invoice must be in the standard format prescribed by the Goods & services Tax department

Tip: Using GST-compliant invoicing software ensures your invoices are in the correct format and can be sent directly to the Goods and Services Tax portal. This saves time and reduces errors.

2. Change in Invoice format

The Goods and Services Tax specifies mandatory fields in an invoice.

- GSTIN of the supplier and the recipient must be clearly mentioned

- HSN codes are mandatory for all goods and services, depending on turnover

- The invoice must include details of discounts, reverse charge, and e–way bill number if applicable

Impact on businesses: If invoices lack these details, the Goods and Services Tax system may reject them. This can delay filing and even lead to compliance issues.

3. Reverse charge mechanism updates

The reverse charge mechanism (RCM) was also updated in 2025. Under RCM, the recipient of goods or services is liable to pay Goods and Services Tax instead of the supplier.

- RCM applies to certain services and goods only

- Digital invoices must indicate whether the supply falls under RCM

- Compliance under RCM is mandatory for all businesses

4. Faster filing and reconciliation

In 2025, GST filings will become more frequent and integrated with invoicing.

- Monthly GST return filings are mandatory for all businesses.

- GST invoicing software now allows auto-reconciliation of input tax credit (ITC) with supplier invoices.

- Late filing penalties are strictly enforced.

Impact on business: Businesses need real-time visibility of invoices and taxes to avoid mismatches. Manual tracking can lead to errors.

5. E-way bill integration

E-way bills are mandatory for the movement of goods worth more than 50,000 in 2025. The GST council made e-way bills even more integrated with invoices

- Invoices must now mention the e-way bill number when goods are transported

- Non-compliance can lead to penalties during transport checks

6. Simplified GST returns for small businesses

For small businesses with a turnover below 5 crore, GST filing has become simpler:

- A new simplified return format is available

- Businesses can report outward supplies and claim ITC in one return

- There is a recommendation for digital Goods and Services Tax invoicing even for smaller businesses.

Impact: Even if you are a small business, adopting GST invoicing software can save you time and make your returns accurate

Why these changes matter

Compliance is stricter: Non-compliance can lead to penalties, rejected invoices and delayed ITC claims.

Manual invoicing is risky: Paper-based invoices or spreadsheets can lead to mistakes.

Digital readiness is essential: Automation is no longer optional; it is necessary for the new Goods and services tax rules.

Changes in GST Returns & Reporting

In 2025, GST e-invoicing rules were expanded to cover more businesses. This helps the government track taxes better and report faster. Smaller businesses are now also required to use e-invoicing, which reduces mistakes in invoices.

One major change was reducing the annual turnover limit for mandatory e-invoicing. Businesses crossing this new limit must generate invoices for B2B transactions through the Invoices Registration Portal (IRP). Medium-sized companies and service providers need to regularly check their turnover to follow the rules. There were also updates the invoice format and IRN generation. Accurate details have become very important; invoices with errors or missing information can be rejected. IRN data is now closely linked with GST returns; entering correct information is mandatory.

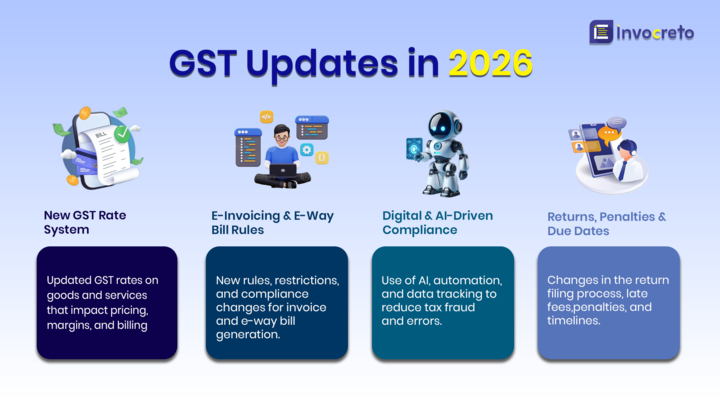

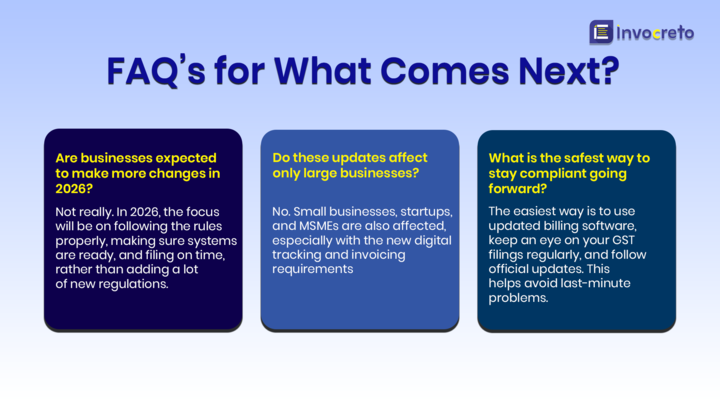

What business should do in 2026

Only one solution is to upgrade to GST invoicing software to keep your business GST-compliant with updated rules. Invocreto invoicing software automatically generates digital invoices in the correct format with auto-calculated Goods and Services Tax calculations.

Benefits:

1. Automatic invoice generation

If you are dealing with multiple clients, manually invoicing will be time-consuming. Our software automatic invoicing generator makes this process easier; you can generate, download, and share an invoice in just a few clicks. You can download your GST-1 invoice report for quick filings.

2. Profession templates

Invocreto software has multiple invoice templates; you can choose a template that matches your business. Also, you can customise your template by adding a logo, changing the color, and adding personal details. Download and share your invoices in a few clicks, or share via email or every everyday use app WhatsApp

3. Accurate invoices

Manual calculation always has mistakes and errors; that’s why our software handles Goods and Services Tax calculation automatically. Goods and Services Tax rates, discounts, and totals are calculated accurately. Our software is auto-updated with new GST updates or rules, which gives you accurate results every time.

4. Keep track of payment

Invocreto software has built-in tracking features that provide real-time updates on your payment status. You don’t have to check each client manually if their payment is done, due, or overdue; the software will show you the real-time status.

5. Integrations with other business tools

Integrations like a payment gateway help with better and quicker cash flow. Connecting your invoice generator to a payment gateway, you can manage your cash flow and invoices on one dashboard, which saves time and effort.

6. Organised invoices

You can generate many invoices with just a few clicks, handle multiple clients, their invoices, and their payments. Keep a record of everything accurately and organised. Our simple dashboard is easy to use and manage, which saves time and effort.

Common mistakes make

Even with awarrances. Mistakes still happen:

- Incorrect GSTIN or HSN codes can cause invoice rejection

- Not generating IRN: Digital invoices without IRN are considered invalid

- Late e-way bill generation: can result in transport penalties

- Manual reconciliation increases the risk of mistakes during filings

Invocreto GST invoicing software solves most of these problems.

Conclusion

The GST updates introduced in 2025 clearly show that the system is moving towards full digital compliance. Rules are stricter, reporting is faster, and even small and medium businesses are expected to follow accurate and timely GST rules. Manual invoicing is now risky; it can result in rejected invoices, penalties, and delayed tax credits.

To stay compliant and avoid unnecessary issues, businesses must upgrade to GST invoicing software. Using Goods and Services Tax invoicing software helps generate correct invoices, track payments, make quick GSTR-1 filings, manage multiple clients, and minimise errors. As Goods and Services Tax rules change continually, being digitally prepared now is not a choice; it is important for smooth and accurate business operation and long-term growth.

No comments yet