If you’ve ever wanted to verify a business’s GSTIN without creating an account or logging into any government portal, you’re in the right place. This article walks you through how to find GSTIN without login, even if you’re a complete beginner — using expert strategies, professional tools, and real-world use cases.

Whether you’re a business owner, finance executive, or simply curious, this is your complete 10-chapter guide to GSTIN search mastery.

🚀 Why Learn to Find GSTIN Without Login?

GSTIN (Goods and Services Tax Identification Number) is a 15-digit unique number that identifies businesses registered under India’s GST law. Knowing how to verify this number is a vital due diligence step for:

- Confirming a business’s legitimacy

- Avoiding fraud and fake vendors

- Maintaining GST compliance

- Enhancing procurement or partnership decisions

- Ensuring secure business transactions

But many platforms ask you to register or log in — delaying the process. Fortunately, there are professional tools like Invocreto that allow you to search GSTINs instantly without creating an account.

🧠 What You’ll Learn in This Guide

- What GSTIN is and how to decode it

- Step-by-step process to find GSTIN without login

- Tools and platforms that simplify the search

- Pro tips for verifying and interpreting results

- Best practices for documentation and compliance

- How to use this for risk assessment and competitive intelligence

- Security and privacy benefits

- Integration with your business systems

📌 Understanding GSTIN: Structure and Significance

Example GSTIN: 27AAPFU0939F1ZV

Let’s break down what each section means:

| Characters | Purpose |

|---|---|

| 1-2 | State code (e.g., 27 = Maharashtra) |

| 3-12 | PAN number of the business owner |

| 13 | Registration number under GST |

| 14 | Default letter (usually Z) |

| 15 | Check digit for error detection |

Why It Matters:

GSTIN is more than just an ID. It’s a snapshot of a business’s:

- Identity

- Legal structure

- Tax compliance

- Industry type

- State presence

- Activity classification

🛠 Tools to Find GSTIN Without Login

Instead of navigating complex government portals, use a free, login-free GSTIN search tool like:

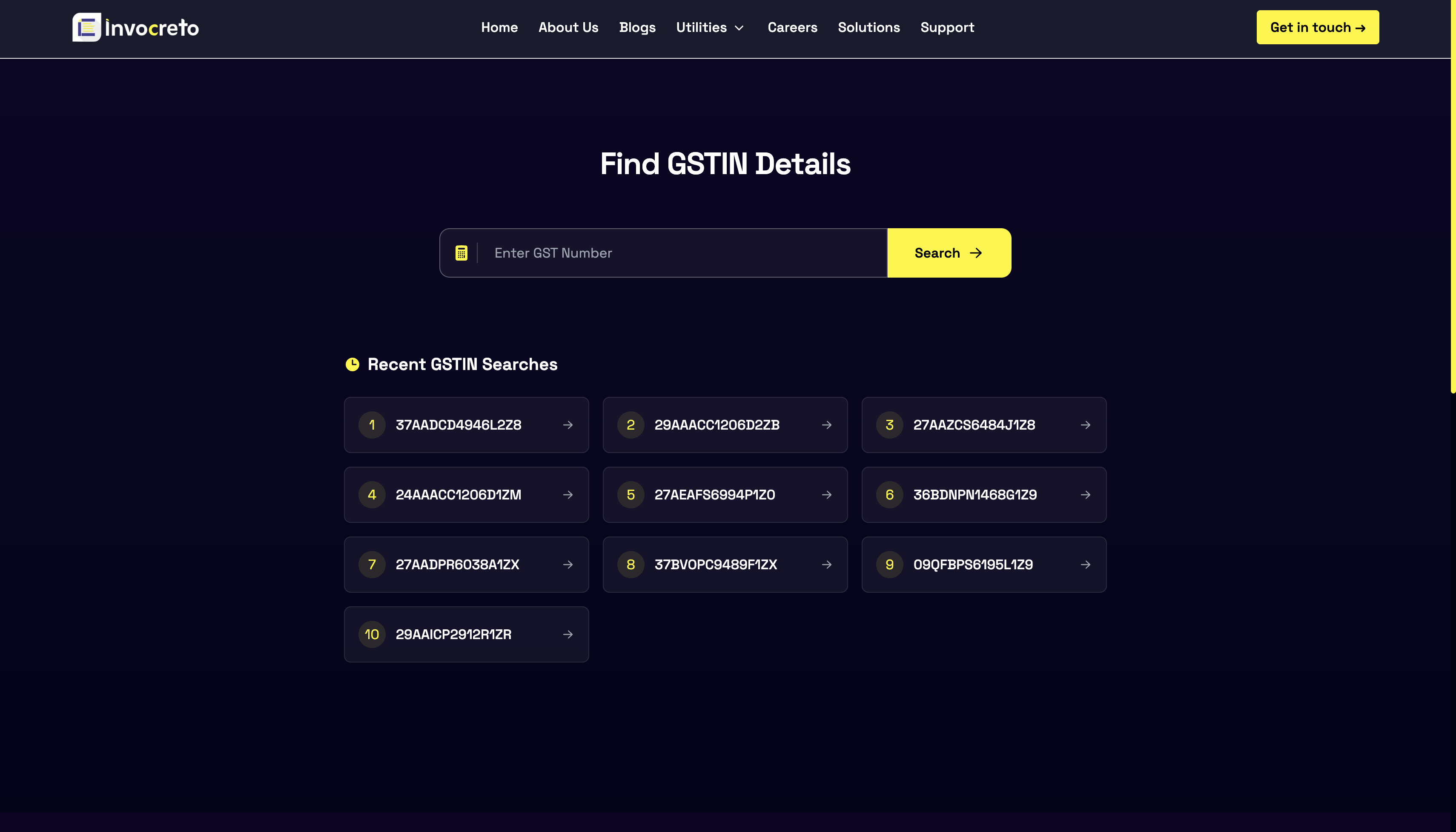

👉 Invocreto GSTIN Finder

This tool offers:

- ⚡ Real-time search with zero registration

- 🔒 Enterprise-grade security

- 📱 Mobile and desktop compatibility

- ✅ Clean, ad-free user interface

- 🔁 Unlimited usage

📲 Step-by-Step: How to Find GSTIN Without Login

1. Open a GSTIN Search Tool

Visit www.invocreto.com.

2. Enter the 15-Digit GSTIN

- Avoid using spaces, symbols, or hyphens

- Double-check for O/0 and I/1 mix-ups

- Use copy-paste from reliable sources when possible

3. Click on “Verify” or “Search”

- Within seconds, the tool fetches the data from live GSTN servers.

🧾 What You’ll See in the Search Results

After submitting the GSTIN, the results will include:

| Field | What It Tells You |

|---|---|

| Legal Name | Official registered name |

| Trade Name | Business aliases (if any) |

| Business Type | Proprietor, Pvt Ltd, LLP, etc. |

| GST Status | Active, Suspended, or Cancelled |

| Registered Address | Full location details |

| HSN/SAC Codes | Nature of products/services |

| Date of Registration | Business age and timeline |

| State Jurisdiction | Legal location |

⚠️ Common Issues & How to Fix Them

Issue 1: Invalid GSTIN

- Likely due to a typo or old/cancelled number

- Double-check formatting and PAN digits

Issue 2: Incomplete Results

- Some businesses provide limited data

- Cross-verify via directories or request their GST certificate

Issue 3: Technical Errors

- Try refreshing the page or switching browsers

- Clear cache or try mobile data if WiFi is unstable

🧷 Why This Method Is Safer & More Private

When you search GSTIN without login, you avoid:

- Sharing your email or phone number

- Receiving spam or promotional emails

- Leaving a traceable digital footprint

- Giving away your search behavior to competitors

This approach is ideal for:

- Discreet competitive research

- Anonymous supplier screening

- Private risk assessments

📋 Business Use Cases for GSTIN Verification

Procurement Teams:

- Verify every supplier before payment

- Flag high-risk vendors with suspended/cancelled GSTINs

- Schedule quarterly checks for compliance

Sales & CRM:

- Validate customer GSTINs before dispatch

- Avoid mismatches in billing addresses

- Maintain audit-ready documentation

Finance Teams:

- Link GSTIN data with ERP

- Automate verification for large vendor databases

- Archive timestamped screenshots for each check

🧩 Strategic Use: GSTIN for Competitive Intelligence

Smart businesses use GSTIN searches for:

- 🏢 Mapping competitor presence across states

- 🧾 Reviewing their product categories via HSN/SAC codes

- 🔎 Identifying new market entrants or dissolutions

- 📦 Exploring possible common suppliers

⚙️ Pro Tips for Automation & Integration

- Use Invocreto’s API to embed verification into your systems

- Schedule weekly bulk verifications for vendor health

- Link verification logs to your accounting or CRM system

- Enable alerts for partner status changes

🏁 Conclusion: GSTIN Search Is a Business Superpower

Knowing how to find GSTIN without login is more than just a convenience — it’s a strategic capability. It helps you:

- Avoid fraud

- Strengthen compliance

- Reduce verification costs

- Make smarter business decisions

Whether you run a startup or an enterprise, verifying GSTINs should be a standard part of your workflow.

✅ Ready to Try It?

👉 Start your first search now at Invocreto GSTIN Finder — no account, no delays, just results.

No comments yet