Learning how to find GSTIN efficiently has become crucial for businesses operating in India’s GST ecosystem. The Goods and Services Tax Identification Number serves as a fundamental identifier for business verification, yet many professionals still struggle with outdated methods that require complex registration processes and account management.

This comprehensive guide demonstrates the most effective ways to find GSTIN without creating accounts, managing passwords, or navigating bureaucratic portals. Whether you’re a procurement manager verifying suppliers, an accountant validating client credentials, or a business owner conducting due diligence, mastering these modern approaches can dramatically improve your operational efficiency and decision-making speed.

The transformation from traditional verification methods to streamlined, accessible processes represents one of the most significant improvements in business compliance tools. Understanding how to leverage these advancements ensures you can find GSTIN information quickly and accurately whenever business needs arise.

Understanding GSTIN and Why You Need to Find GSTIN Information

The Goods and Services Tax Identification Number represents a unique 15-digit identifier that contains essential information about every business registered under India’s GST system. This alphanumeric code follows a specific structure that reveals the business’s state of registration, PAN details, and validation information.

Learning to find GSTIN effectively serves multiple critical business purposes. First, it enables verification of business legitimacy before entering into partnerships, contracts, or transactions. Second, it ensures tax compliance by confirming that vendors and suppliers maintain active GST registrations. Third, it helps prevent fraud by identifying invalid or inactive GSTIN numbers that dishonest entities might attempt to use.

The GSTIN structure follows a precise pattern: the first two digits indicate the state code, the next ten digits represent the PAN of the legal entity, the thirteenth digit shows the registration sequence number, and the final two digits serve as check digits for mathematical validation. Understanding this structure helps you find GSTIN information more effectively and identify potential errors in provided numbers.

Traditional Methods vs Modern Ways to Find GSTIN

Historically, attempts to find GSTIN information required creating accounts on official GST portals, completing lengthy verification processes, and maintaining multiple sets of login credentials. This approach created significant barriers for businesses that needed occasional verification services or had limited administrative resources.

Traditional methods imposed several challenges: time-consuming registration procedures, complex password management requirements, potential security vulnerabilities from storing sensitive login information, and unnecessary administrative overhead for infrequent users. Small businesses particularly struggled with these requirements, often delaying important verification activities due to the perceived complexity.

Modern approaches have revolutionized how professionals find GSTIN information by eliminating registration barriers and providing immediate access to accurate, real-time data. These streamlined methods leverage public databases and user-friendly interfaces that deliver the same comprehensive information without requiring personal data collection or account creation.

Why You Should Find GSTIN Without Account Registration

The shift toward account-free methods to find GSTIN addresses several critical business needs that traditional approaches failed to meet effectively. Speed represents the most immediate advantage – instant verification capabilities support faster decision-making in competitive business environments.

When evaluating potential suppliers during urgent procurement processes or onboarding new vendors with tight project deadlines, the ability to quickly find GSTIN information becomes a significant competitive advantage. Traditional account-dependent methods often introduced delays that could cost valuable business opportunities.

Security considerations strongly favor account-free approaches when you need to find GSTIN information. By eliminating the requirement to store login credentials, businesses reduce their exposure to data breaches, password-related security incidents, and unauthorized access attempts. This approach particularly benefits organizations with strict cybersecurity policies that limit external account creation.

Cost efficiency represents another compelling factor. The ability to find GSTIN without maintaining accounts eliminates administrative overhead associated with account management, password resets, user training, and ongoing maintenance activities. For businesses that verify GSTIN numbers sporadically, this approach provides substantial cost savings compared to maintaining active accounts across multiple platforms.

Multiple Methods to Find GSTIN Without Logging In

Several reliable approaches enable you to find GSTIN information without creating accounts or managing login credentials. Understanding these various methods helps you select the most appropriate option for your specific verification requirements and business context.

Official Government Portal Public Search

The GST portal provides robust public search functionality that allows you to find GSTIN information using the same database that registered users access. This method ensures maximum accuracy and provides real-time information directly from authoritative government sources.

The portal’s public search feature accepts complete GSTIN numbers and returns comprehensive business information including legal name, registration status, business type, and operational details. This approach guarantees data authenticity while maintaining the convenience of account-free access.

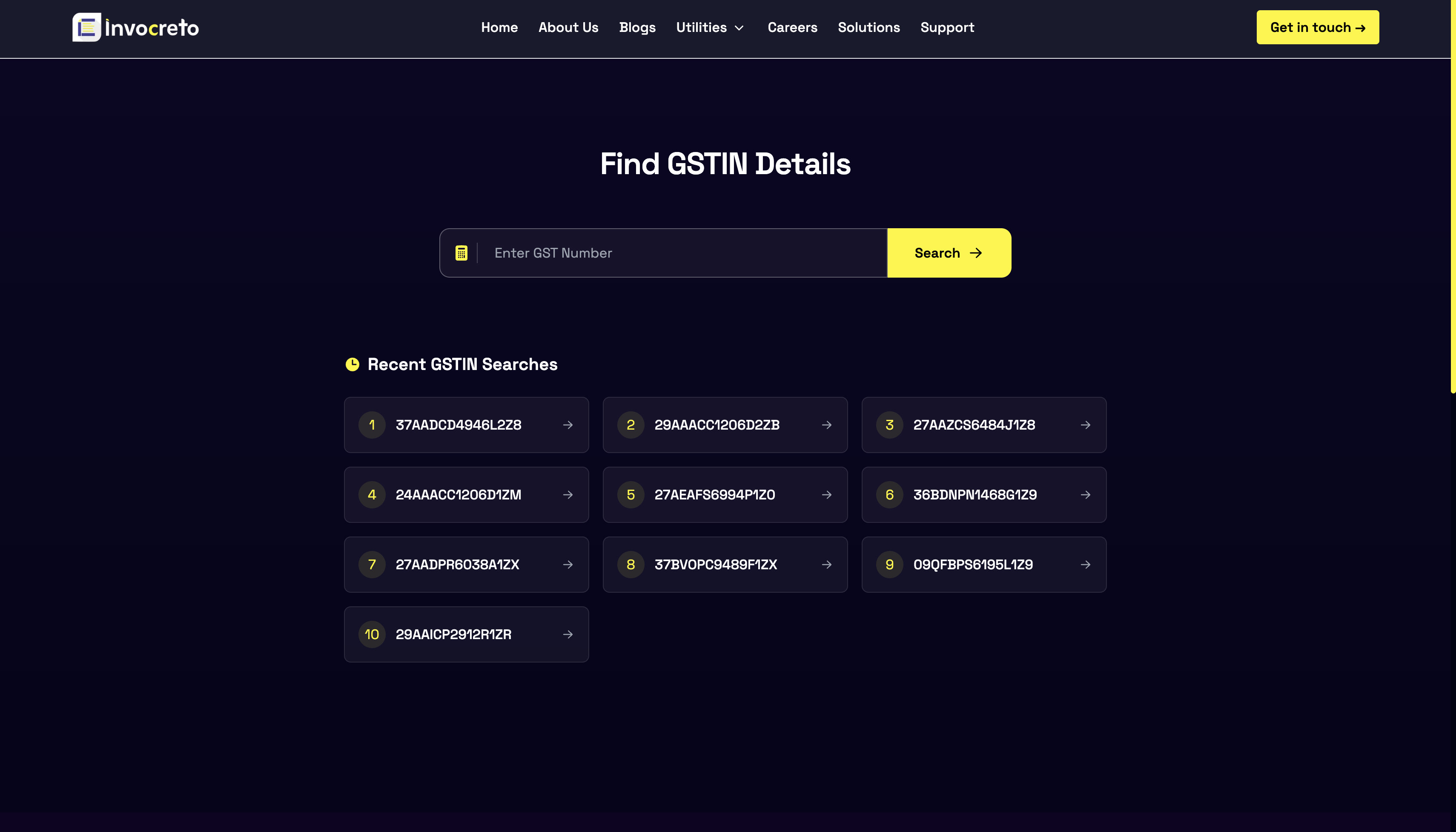

Third-Party Verification Platforms

Legitimate third-party services have developed user-friendly interfaces that help you find GSTIN information quickly and efficiently. These platforms often enhance basic verification processes with additional features like bulk verification capabilities, data export options, and integration possibilities for existing business systems.

When selecting third-party platforms to find GSTIN information, prioritize services with established reputations, transparent data sourcing practices, and clear privacy policies. Quality platforms typically provide the same accuracy as official sources while offering improved user experiences and additional functionality.

API-Based Integration Solutions

For businesses requiring frequent GSTIN lookups, API-based solutions offer programmatic methods to find GSTIN information and integrate verification capabilities directly into existing business systems. These solutions enable automated verification workflows, bulk processing capabilities, and seamless integration with CRM, ERP, and procurement systems.

Many API providers offer free-tier access for basic verification needs, scaling to premium features for high-volume users. This approach helps businesses find GSTIN information efficiently while building verification capabilities into their standard operating procedures.

Mobile Application Solutions

Several mobile applications provide convenient ways to find GSTIN information without requiring user registration or account creation. These apps often include additional features like QR code scanning, offline verification capabilities, and integration with device contact management systems.

Mobile solutions particularly benefit field-based professionals who need immediate access to find GSTIN information while meeting with potential partners, suppliers, or clients. The portability and instant access capabilities make mobile apps valuable tools for business development and compliance activities.

Step-by-Step Process to Find GSTIN Information

Implementing effective methods to find GSTIN information follows a systematic approach that ensures accuracy while maximizing the usefulness of obtained data. This comprehensive process applies regardless of your chosen verification method.

Step 1: Obtain and Verify the GSTIN Number Ensure you have the complete 15-digit GSTIN number with all characters clearly visible and correctly transcribed. Even single-digit errors will prevent successful attempts to find GSTIN information. Familiarize yourself with the GSTIN format structure to identify obvious transcription errors before beginning verification.

Step 2: Select Your Verification Platform Choose the most appropriate method to find GSTIN information based on your specific needs, frequency of use, and integration requirements. Consider factors like data accuracy requirements, additional feature needs, and organizational security policies when making this selection.

Step 3: Access the Chosen Platform Navigate to your selected verification platform, ensuring you’re accessing legitimate services by verifying URLs, checking for security certificates, and confirming platform reputations. Avoid platforms that request unnecessary personal information or payment details for basic verification services.

Step 4: Input the GSTIN Number Enter the 15-digit GSTIN number into the designated search field, double-checking the entered number against your source document to prevent errors. Many platforms provide real-time validation that highlights formatting errors as you type, helping ensure successful attempts to find GSTIN information.

Step 5: Execute the Search Query Submit the verification request and allow the system to process your query. Processing times vary by platform but typically complete within seconds for valid GSTIN numbers. Be patient during peak usage periods when response times might be slightly longer.

Step 6: Analyze the Returned Information Carefully examine the results when you successfully find GSTIN information. Valid entries typically display comprehensive business details including legal name, registration date, business type, operational status, and compliance information. Pay particular attention to the registration status, which should indicate “Active” for legitimate, compliant businesses.

Step 7: Document and Store Results Save or document the verification results for your records, audit trails, and compliance documentation. Many platforms provide options to download or print verification reports, which can be valuable for future reference and regulatory compliance purposes.

Advanced Techniques to Find GSTIN Efficiently

Developing advanced capabilities to find GSTIN information involves understanding optimization strategies, bulk processing options, and integration possibilities that can significantly improve your verification efficiency and accuracy.

Bulk Verification Strategies

For businesses that regularly need to find GSTIN information for multiple entities, bulk verification approaches can dramatically improve efficiency. Many platforms offer batch processing capabilities that allow you to verify dozens or hundreds of GSTIN numbers simultaneously.

Bulk verification strategies require careful planning to ensure data accuracy and compliance with platform usage policies. Prepare your GSTIN lists in standardized formats, validate data quality before submission, and implement proper error handling procedures for invalid or problematic entries.

Integration with Business Systems

Advanced users can find GSTIN information more efficiently by integrating verification capabilities into existing business systems. This approach automates verification processes, reduces manual data entry errors, and ensures consistent compliance practices across organizational activities.

Integration possibilities include connecting verification APIs with procurement systems, customer relationship management platforms, accounting software, and compliance management tools. These integrations help you find GSTIN information seamlessly within existing workflows.

Data Quality and Validation Practices

Implementing robust data quality practices ensures that your efforts to find GSTIN information produce reliable, actionable results. Develop standardized procedures for data collection, validation, and storage that maintain accuracy while supporting audit requirements.

Quality practices include double-checking source documents, implementing verification workflows that catch common errors, maintaining audit trails of verification activities, and establishing procedures for handling discrepancies or questionable results.

Common Challenges When Trying to Find GSTIN

Understanding frequent obstacles that arise when attempting to find GSTIN information helps you troubleshoot issues quickly and maintain consistent verification success rates.

Format and Transcription Errors The most common challenge when trying to find GSTIN information involves input errors caused by incorrect transcription or formatting. GSTIN numbers use specific alphanumeric patterns that must be entered exactly as registered.

Common transcription errors include confusing similar characters like ‘O’ and ‘0’, ‘I’ and ‘1’, or ‘S’ and ‘5’. When copying GSTIN numbers from physical documents, poor print quality or handwriting can contribute to these errors. Implementing double-checking procedures significantly reduces these issues.

Platform Connectivity and Performance Issues

Network connectivity problems can interfere with attempts to find GSTIN information, particularly during peak usage periods or when accessing platforms with high server loads. Understanding these limitations helps you plan verification activities effectively.

If experiencing slow responses or connection timeouts, try accessing verification platforms from different networks, at different times, or through alternative methods. Many platforms experience higher traffic during business hours, so scheduling verification activities during off-peak periods can improve performance.

Data Synchronization and Accuracy Concerns

While efforts to find GSTIN information generally produce accurate results, occasional discrepancies may occur due to recent database updates, registration changes, or synchronization delays between different data sources.

When verification results seem inconsistent with expectations, consider verifying through multiple platforms, contacting the business directly for clarification, or checking for recent changes in business registration status. Understanding these limitations helps you interpret results appropriately.

Security Best Practices When You Find GSTIN Information

Implementing proper security measures ensures that your activities to find GSTIN information protect both your organization and the businesses you’re verifying while maintaining data integrity and compliance with privacy regulations.

Platform Security Verification

Always verify that you’re using legitimate, secure platforms when attempting to find GSTIN information. Check for secure connections (HTTPS), read privacy policies carefully, and research platform reputations before entering any GSTIN numbers or business information.

Avoid platforms that request unnecessary personal information, payment details for basic verification services, or excessive permissions for mobile applications. Legitimate verification services focus on providing GSTIN information without collecting unrelated personal data.

Data Handling and Storage Protocols

Treat information obtained when you find GSTIN details as sensitive business data requiring appropriate protection measures. Implement proper storage controls, access restrictions, and retention policies for verification results, particularly when conducting bulk verifications or maintaining verification databases.

Consider the business sensitivity of collected information and implement protection measures proportionate to the data’s value and regulatory requirements. This includes secure storage solutions, controlled access procedures, and proper disposal methods for outdated verification records.

Privacy and Ethical Considerations

Remember that efforts to find GSTIN information access publicly available business data, but this information should be used responsibly and ethically. Comply with applicable privacy laws, business ethics standards, and organizational policies when collecting and using verification results.

Use obtained information only for legitimate business purposes, respect the privacy rights of verified businesses, and avoid sharing verification results unnecessarily or inappropriately. Responsible use practices protect both your organization and the broader business community.

Business Applications for GSTIN Finding

The ability to efficiently find GSTIN information supports numerous business applications across various industries and organizational structures. Understanding these use cases helps identify opportunities to improve business processes through effective verification strategies.

Supplier Management and Procurement

Procurement teams regularly find GSTIN information to validate potential suppliers before initiating business relationships. This verification ensures compliance with tax regulations, reduces risks associated with non-compliant entities, and supports vendor qualification processes.

Effective supplier verification helps organizations build reliable supply chains, ensure regulatory compliance, and reduce procurement risks. The ability to quickly find GSTIN information enables faster supplier onboarding while maintaining thorough due diligence standards.

Customer and Client Verification

Service providers often need to find GSTIN information for clients to ensure accurate invoicing and compliance with GST regulations. This verification proves particularly important for B2B service providers who must collect and remit appropriate taxes based on client registration status.

Customer verification processes help ensure billing accuracy, regulatory compliance, and proper tax handling. The ability to efficiently find GSTIN information supports these processes while reducing administrative overhead and compliance risks.

Financial Due Diligence and Investment Analysis

Financial institutions and investors frequently find GSTIN information as part of comprehensive due diligence processes. Active GSTIN registration often serves as an indicator of business legitimacy, operational compliance, and regulatory adherence.

Investment analysis processes benefit from the ability to quickly find GSTIN information and verify business credentials. This verification supports risk assessment, compliance evaluation, and investment decision-making processes.

Future Trends in GSTIN Verification

The evolution of methods to find GSTIN information continues advancing toward greater automation, integration capabilities, and enhanced accuracy. Understanding these trends helps businesses prepare for future verification needs and technology adoption opportunities.

Emerging technologies like artificial intelligence and machine learning are being integrated into verification platforms to improve accuracy, detect potential fraud, and enhance user experiences. These advancements will make it even easier to find GSTIN information while providing additional insights and validation capabilities.

API standardization and improved integration capabilities are expanding the possibilities for embedding verification functions into business systems. Future developments will likely provide more seamless ways to find GSTIN information within existing workflows and automated business processes.

Conclusion

Mastering the ability to find GSTIN information efficiently represents a crucial skill for modern business operations in India’s GST environment. The evolution from complex, account-dependent verification methods to streamlined, accessible approaches has democratized access to essential business verification capabilities.

The comprehensive methods and best practices outlined in this guide provide complete coverage of modern approaches to find GSTIN information, from basic single-number verification to advanced bulk processing and system integration capabilities. By implementing these strategies, businesses of all sizes can improve their verification efficiency, enhance security, and reduce administrative overhead.

Whether you need to find GSTIN information occasionally or implement systematic verification processes, the account-free approaches detailed in this guide offer compelling advantages that support better business decisions while maintaining high standards of accuracy and security. The key lies in selecting appropriate methods for your specific requirements and implementing proper procedures to maximize the benefits of these powerful verification capabilities.

As businesses continue prioritising efficiency, security, and compliance, the ability to effectively find GSTIN information will become increasingly essential for successful operations in India’s dynamic business environment.

No comments yet