In the modern business world, speed matters. Everyone wants to close deals more quickly, send invoices faster, and get paid sooner. But in this race, one important step is often skipped, which is GSTIN verification.

If you run a business or work in accounting, you already know that GST (Goods and Services Tax) plays a huge role in your daily operations. One of the most important aspects of GST compliance is obtaining a GSTIN. If you’re a freelancer, shopkeeper or growing entrepreneur, skipping this step can cost you. So let’s learn why GSTIN verification matters, and how to do it right

What is GSTIN, and why do we use it?

GSTIN stands for Goods and Services Tax Identification Number. It’s a 15-digit unique code assigned to every registered GST taxpayer in India.

Example GSTIN format: 22AAAAA0000A1Z5

Each digit in GSTIN has meaning:

- The first two digits represent the state code

- The next ten digits are the PAN of the business

- The 13th digit shows the number of registrations for the same PAN in the state

- The 14th digit is the default

- The 15th digit is the checksum

This number is used for:

- Filing GST returns

- sending or receiving GST invoices

- Claiming input tax credit (ITC)

- Official business identification

- Here’s what GSTIN does

- Identifies business during GST filings

- helps track tax payments

- helps the government monitor compliance

- Ensures transparency in business operations

What is GSTIN verification?

GSTIN verification simply means checking if the GST number is valid, active, and belongs to the same business category that is sharing it with you.

Verification helps confirm:

- GST number is correct

- The taxpayer is registered under GST

- GSTIN is active

- Business name and address match

- Filing status is proper

This ensures that you’re dealing with a legitimate party and that your invoices won’t cause issues during GST returns.

Why is GSTIN verification before creating any invoice so crucial

1. Prevents fake or fraudulent GSTIN usage

If you’re issuing an invoice with a GSTIN that doesn’t exist or belongs to a different person:

- Your invoice becomes invalid

- Your input tax credit (ITC) claims may be rejected

- You might end up facing penalties

Fake GSTIN use is more common than people think. Some dishonest vendors share fake GSTINs to avoid tax or deceive buyers. Verifying GSTIN helps you avoid falling into such traps.

2. Helps you claim input tax credit smoothly

If you are a business that buys goods or services from other registered dealers, ITC is extremely important.

You can use ITC only if:

- Your vendor has a valid GSTIN

- They file proper GST returns

- Invoice details match GST portal data

Using an unverified or incorrect GSTIN results in an ITC mismatch, which means you may lose your tax credit completely.

3. Avoids penalties during GST audits – Incorrect GSTINs can lead to:

- Notice from the tax department

- Fines from the tax department

- Audit queries

- Transaction disallowance

These issues can affect your finances and reputation. GSTIN verification acts like a safety shield. It shows you have followed the rule and due process, which protects you during audits

4. Builds trust and transparency in business relationships

A business that verifies GSTINs shows professionalism and compliance. It shows your client or vendors:

- You follow proper procedures

- You care about legal accuracy

- You are a reliable partner

5. Accurate data entry

Typing or copying GSTIN manually increases the chances of mistakes. Just one incorrect digit can create huge problems.

Verifying GSTIN, make sure:

- Correct business name

- Correct address

- Correct registration type

- Correct tax structure

6. Protects you from dealing with suspended or cancelled GSTINs – Sometimes, businesses get their GST registration suspended due to:

- Filing issues

- Non-compliance

- wrong information

- voluntary closure

If you accidentally issue an invoice against a suspended GSTIN, the invoice becomes invalid. GSTIN verification lets you immediately see if the GST number is active, cancelled, or suspended. This saves you from future complications.

7. Helps avoid wrong tax calculations

GST structure: regular taxpayer, composition scheme, SEZ unit, casual taxpayer. So if you enter the wrong GSTIN, you may apply the wrong tax rate, which affects your GST liability. Verification ensures you have applied the correct tax rate as per the customer’s business type.

8. Makes GST return filing easier and error-free – Using verified GSTIN means:

- No mismatched invoice

- Smooth reconciliation

- No errors while filing GSTR-1 or GSTR-3B

- Smooth reconciliation

How to verify GSTIN?

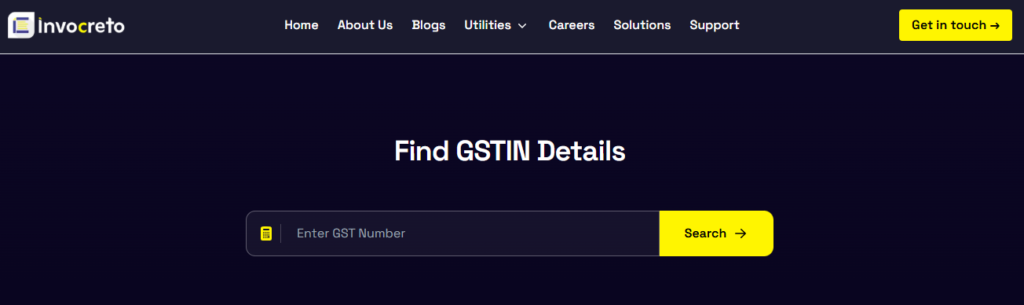

GSTIN verification is easier than most people think. You can verify it in a few clicks by using our GSTIN finder tool.

- Visit our GSTIN finder page

- Entre GSTIN number

- The tool will show all details like business name, taxpayer type, business address, and the Constitution of Business

Common errors businesses make with GSTIN

- Relying on a vendor-shared GSTIN without checking

The vendor can share an old GSTIN, a wrong GSTIN, or a cancelled GSTIN, so always verify it.

- Maintaining GSTIN records manually

Manual record-keeping leads to errors. Digital verification is faster and safer. - Not checking the GSTIN status regularly

A GSTIN can become inactive at any time. Checking it only once is not enough for long-term vendors. - Copy-paste mistake in GSTIN

GSTIN looks confusing because it contains the state code, PAN, registration number, and checksum. Even a small typing mistake changes the entire structure.

Assuming GSTIN is valid if the tax invoice looks genuine

Some fraudulent businesses create real-looking invoices with fake GSTIN. So always verify your GSTINs

What happens if you use an unverified or incorrect GSTIN?

- Your invoice becomes invalid:

An invoice with an incorrect GSTIN loses its GST value. It may be treated as a non-GST invoice - ITC gets blocked or reversed:

GST authorities may ask you to reverse the ITC gained on unverified invoices. This can affect your cash flow. - You may receive compliance notices:

An incorrect GSTIN can lead to mismatch notices, penalty warnings, and audit inquiries. These consume unnecessary time and energy. - Your vendor or customer relationship gets affected:

If mistakes continue, they may lose trust in your business. - Loss of reputation:

Consistent GST errors may create an image of poor compliance.

Benefits of making GSTIN verification part of your workflow

Zero GST mistakes: Checking GSTIN details stops errors right at the start. No more wrong tax numbers or fake suppliers messing up your records.

Smooth GST filing every month: with verified info, your tax returns without delays or fixes. You file on time and avoid last-minute stress.

Higher accuracy in accounting: Clean data means your books stay correct. Spot issues early and keep track of money flow better.

Better vendor management: Know exactly who you’re dealing with. Pick reliable partners and build stronger ties with honest suppliers.

Higher compliance score: Tax authorities see you as a rule-follower. This can lead to fewer checks and faster approval.

Lower risk of tax penalties: Avoid fines and extra charges by catching problems before they grow. Peace of mind for you and your team.

Better financial control: See the real picture of your costs and sales. Make smart choices on spending and growth

Saves time and effort: Quick checks now prevent hours of fixing later. Your team focuses on growing business, not chasing errors.

Builds trust with everyone: customers, banks, and partners feel safe working with you. Good name spreads by word of mouth.

Who should verify GSTIN regularly?

- Businesses issuing invoices

- Vendors and suppliers

- Freelancers dealing with GST clients

- E-commerce sellers

- Retailers and wholesalers

- Transporters

- Service provider

- Tax consultants

- Corporate finance teams

So, anyone creating a GST invoice or accepting one should verify the GSTIN every time

How often should you verify GSTIN?

- New vendors or customers: verify GSTIN before first invoice

- Regular vendors: Verify GSTIN once every month or quarter.

- Large or high-value transactions: verify GSTIN before every invoice

- If you notice something suspicious, verify immediately

Final thoughts

Checking GSTIN before making an invoice may seem like a small task, but it is very important for every business. It helps make sure that invoice details are correct and valid. When GSTIN is verified, your customers can easily claim their Input Tax Credit without any problems. This also keeps your GST returns clean and reduces the chances of errors.

By verifying GSTIN in advance, businesses can avoid fines, rejected invoices, and mistakes in tax filings. It also saves time by reducing follow-ups, corrections, and confusion later. When invoices are accurate, payments are processed faster, and relationships with clients stay smooth.

Most importantly, GSTIN verification shows that your business follows rules and takes compliance seriously. It builds trust with customers, partners, and tax authorities. This simple step help businesses stay organised, reduce stress, and manage billing more efficiently. GSTIN verification before invoicing makes your business operation safer, smarter, and more reliable.

No comments yet