Filing the GSTR-1 report is an important requirement for all regular GST-registered businesses in India. It shows details of all sales and supplies made during a specific time period. This report helps buyers claim their Input Tax Credit (ITC) and make sure the seller is following GST rules. Whether you’re new to GST or want to improve how you file your returns, this guide is a simple and practical resource to help you understand and manage GSTR-1 filing easily.

What is GSTR-1

GSTR-1 is a return that every business registered under GST has to file monthly or quarterly. It shows all sales and supplies of goods and services made during that time. It includes detailed information about invoices issued to customers, export details, credit or debit notes, and any subsequent changes. This helps government and buyers verify sales and make sure that Input Tax Credit (ITC) is claimed correctly.

Who Must File GSTR-1?

All regular businesses registered under GST must file GSTR-1 if they sell or supply goods and services. This includes individuals, partnerships, companies, and casual taxable persons. They need to file a return even if they have no sales during the period by submitting a “nil return”. Some taxpayers do not have to file GSTR-1. These include businesses those under the composition scheme, input service distributors, non–resident taxpayers, and few other special cases.

All GST-registered businesses must file GSTR-1 except:

- Businesses registered under the Composition Scheme (they file GSTR-4 instead).

- Non-resident taxable persons who do not have a permanent establishment in India (they file GSTR-5).

- Input service distributors (they file GSTR-6).

- Suppliers of Online Information Database Access or Retrieval (OIDAR) services located outside India (they file GSTR-5A).

- Taxpayers who deduct tax at source (TDS) under GST (they file GSTR-7).

GSTR-1 filing due date

The filing frequency depends on the business turnover. Businesses with yearly sales above ₹5 crore must file GSTR-1 every month. And businesses with sales of up to ₹5 crore can file quarterly under the special scheme.

- Monthly GSTR-1 Filing date: 11th of the following month

- Quarterly (QRMP) GSTR1 filing date : 13th of following quarter

Note: Late filing attracts a fee of ₹50 per day and can result in blocked e-way bill generation and 18% per annum interest on outstanding tax.

Latest Changes and Compliance Requirements in 2025

In 2025, several key changes were made to the GSTR-1 filing rules.

- HSN codes must now be reported in more detail at 4 or 6 digit levels based on the business’s turnover, and separately for B2B and B2C sales.

- Table 13, which shows details of the issued document, is now mandatory to improve transparency.

- Filing deadlines are stricter, and returns cannot be changed after three years from the due date.

- Real-time validation and automatic data filing have also been introduced to reduce mistakes and data mismatches.

How to file GSTR-1

Step 1: Create Invoices

Start by using Invocreto invoicing software to make invoices that are quick and simple. You can create as many invoices as needed for different clients, which are accurate and follow GST rules.

Step 2: Export Invoice Report

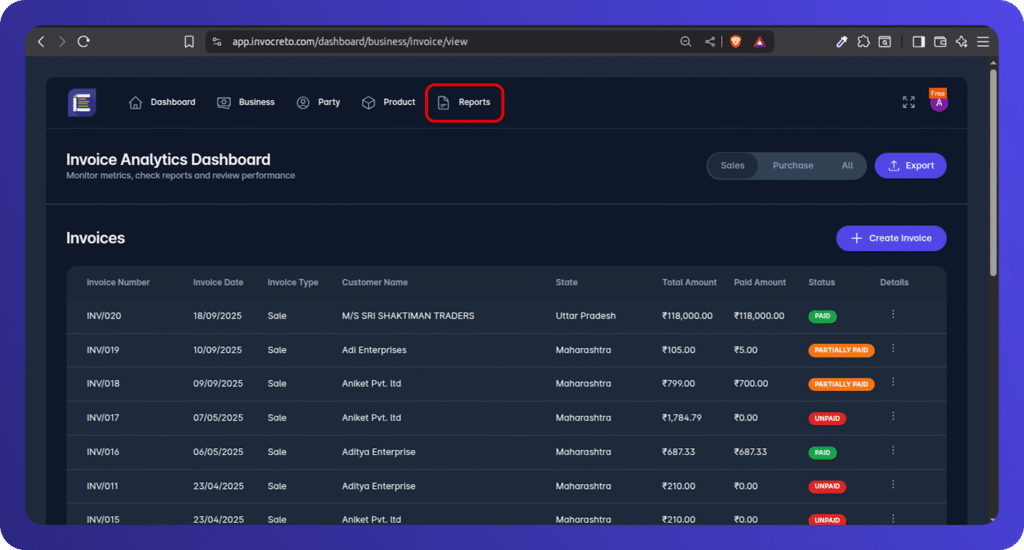

To file GSTR-1, go to the “Reports” section in the software.

Step 3: Select Filing Month

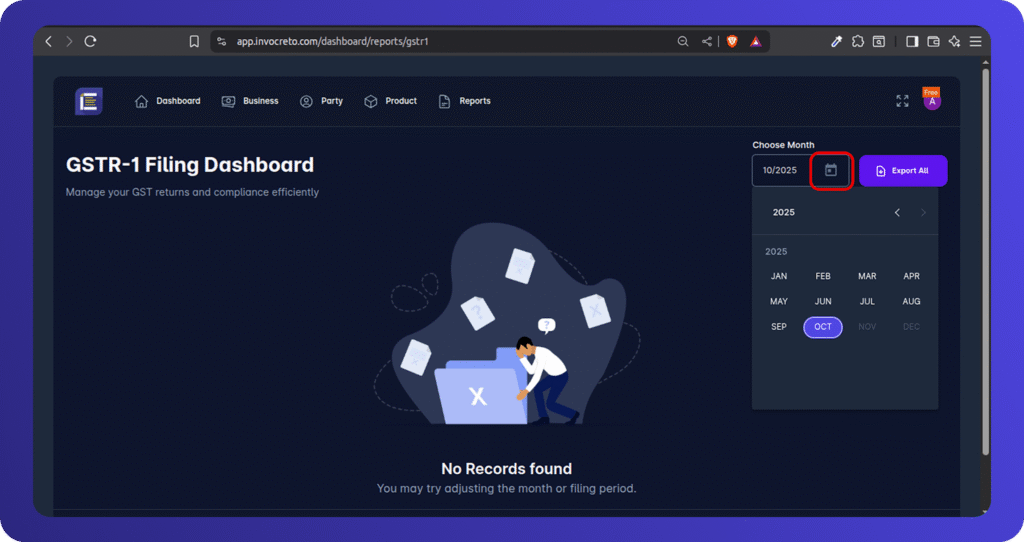

On the GSTR-1 filing dashboard, pick the month for which you want to export your invoice data.

Step 4: Export Invoices

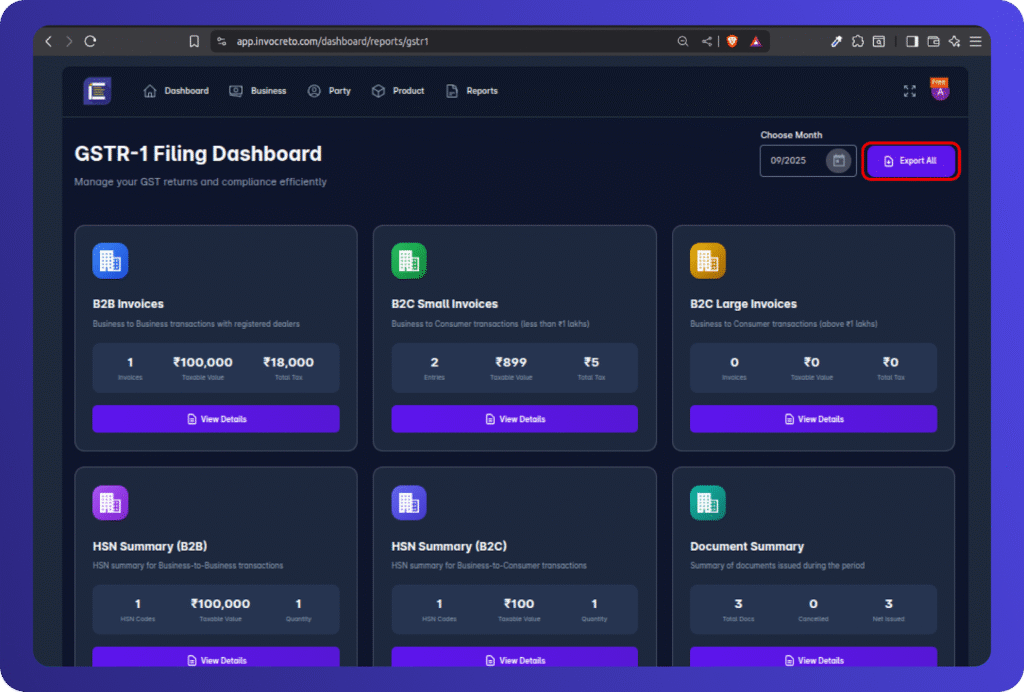

Click on “Export All” to download your invoice report (JSON file).

Step 5: Upload to GST Portal

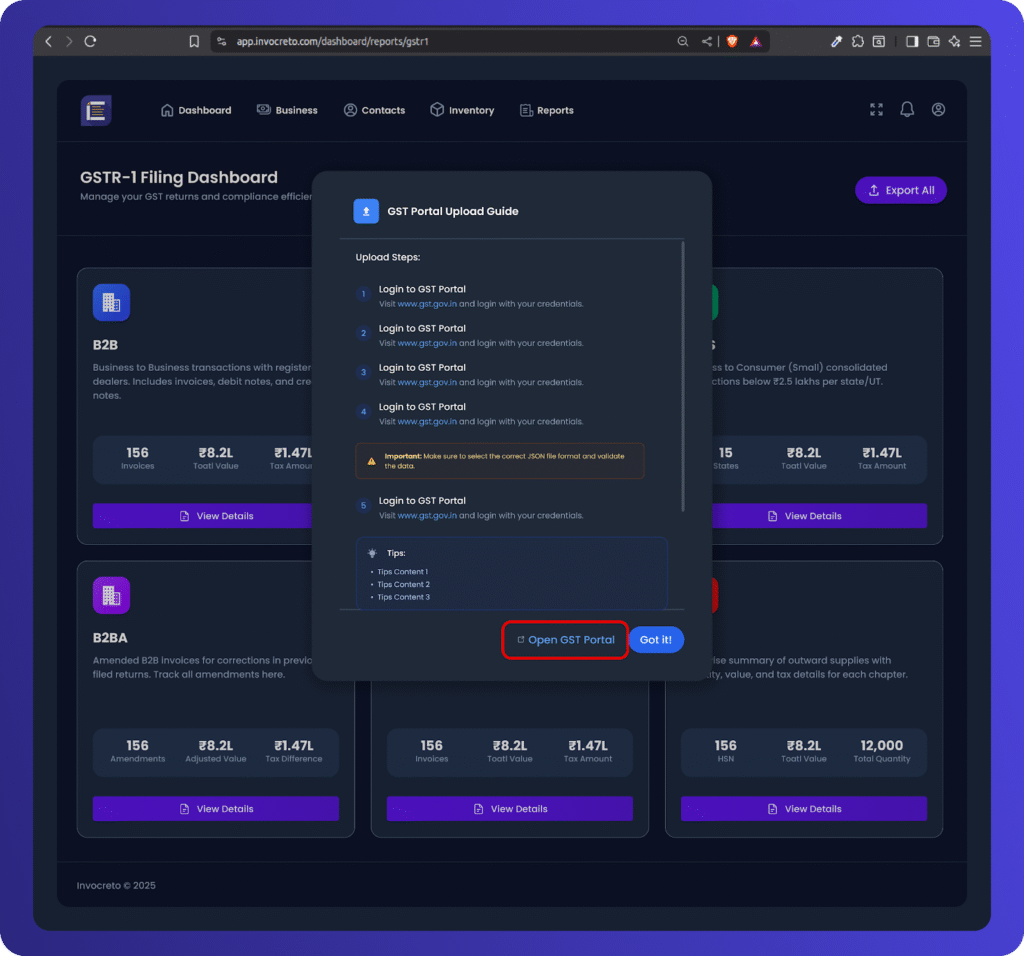

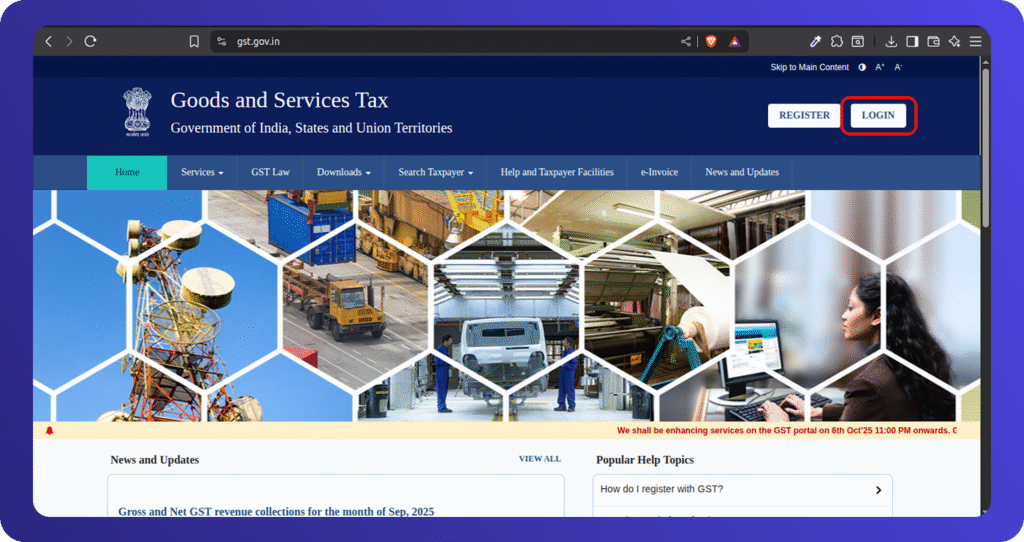

After exporting, upload this JSON file to the official GST portal. You can open the GST portal directly from the pop-up by clicking “Open GST Portal” or visit it manually at www.gst.gov.in.

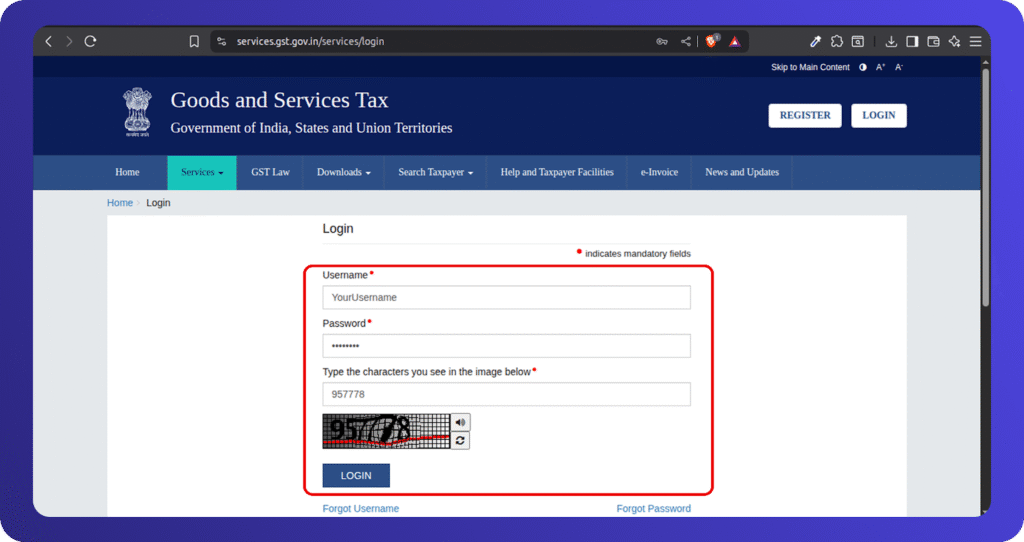

Step 6: Log In

Sign in to the GST portal using your accurate GSTIN and password.

Step 7: Access Services

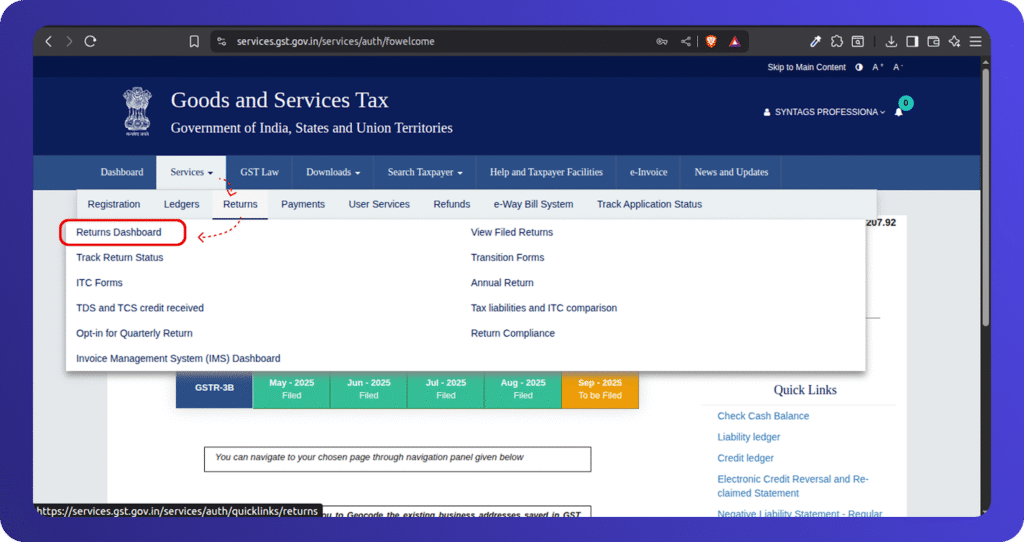

Once logged in, click on “Services.

Step 8: Go to Returns Dashboard

From the “Services” menu, select “Returns,” then go to the “Returns Dashboard.

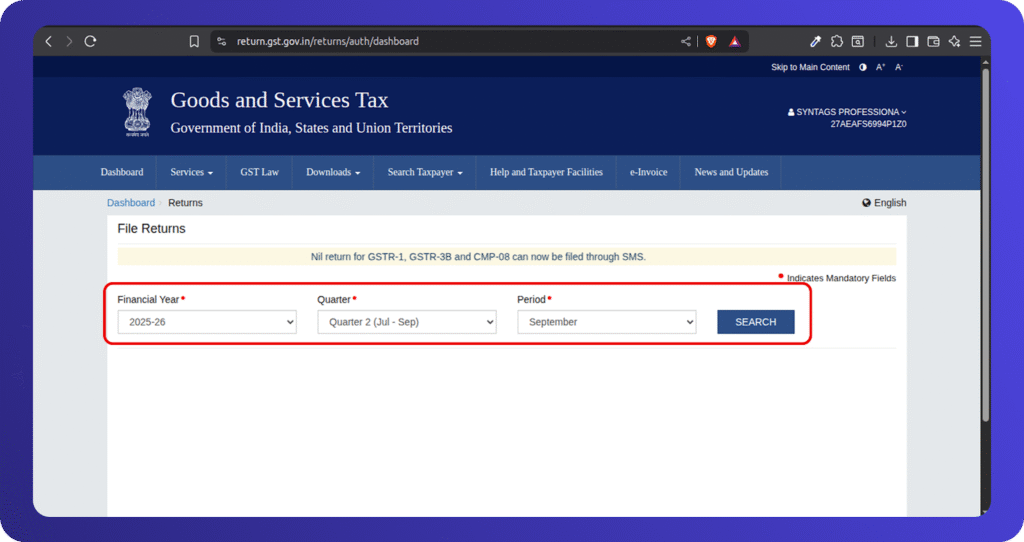

Step 9: Choose Financial Year and Period

Select the correct financial year and the month or quarter for which you are filing the return.

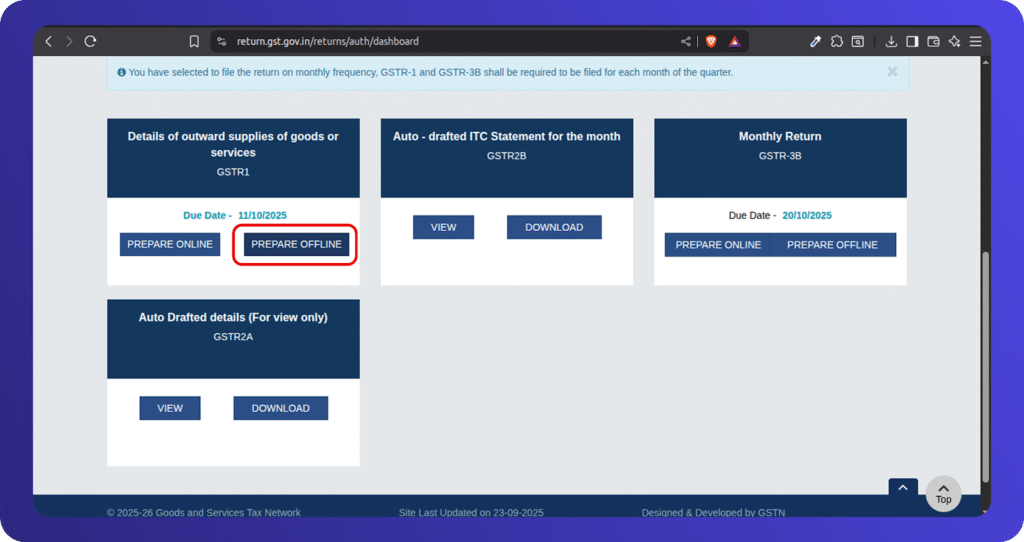

Step 10: Prepare GSTR-1

Click on “Prepare Online” for GSTR-1 filing.

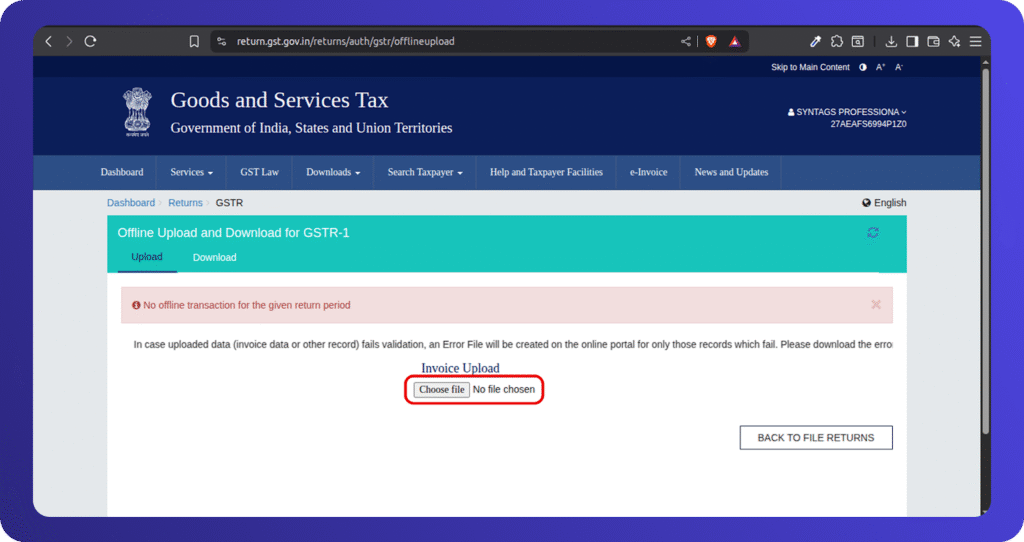

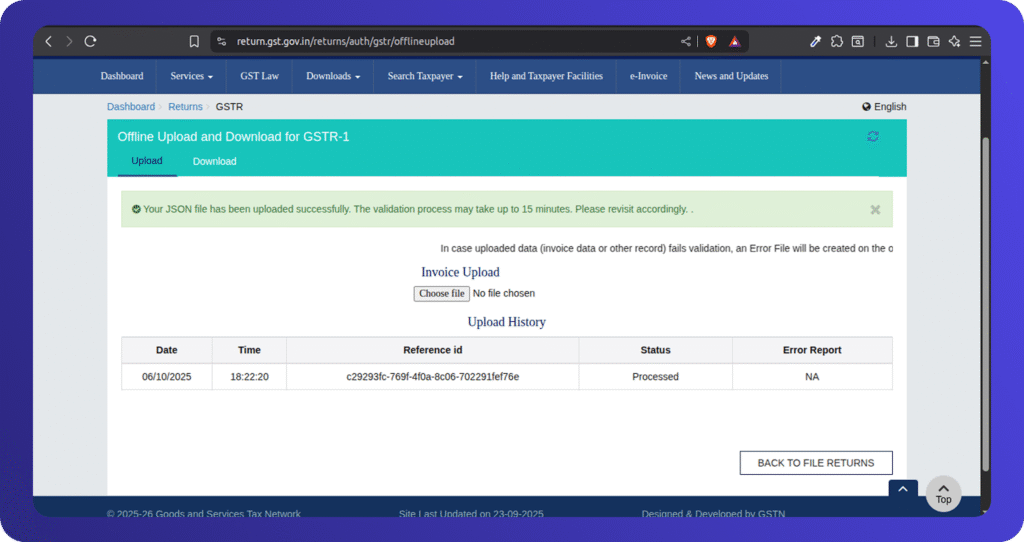

Step 11: Upload JSON File

Click on “Choose File” and select the JSON invoice report you exported earlier.

Step 12: Submit Return

After uploading, submit your GSTR-1 return. Your filing will be processed successfully.

Benefits of Using Our GST Software for GSTR-1 Filing

Invocreto GST software helps businesses handle GST compliance easily and accurately with practical, solution-based tools and services:

Compliance Confidence

- Our software is updated regularly with the latest GST rule changes for 2025, and keeps you audit-ready and fully compliant.

- Generates the necessary JSON files quickly that can be directly uploaded to the GST portal.

Timely filing with Accuracy

- Automatic reminders and alerts keep you informed about upcoming filing dates and help you avoid penalties.

- Real-time checks highlight duplicate entries, missing HSN codes, or incorrect GSTINs, ensuring correct filing.

Cloud Access and Security

- Securely access and export your invoices from any device, anytime, with cloud access.

- Keep your financial data safe with strong encryption, secure cloud storage, and reliable backup recovery.

Our invoicing software helps you easily export accurate GSTR-1 reports. To save even more time and effort, you can also file through the India Corporate GST Return filing. Just share the required documents, and the expert team will handle all further processes. This will prevent costly mistakes and make sure your GSTR-1 filings are always accurate and on time.

Why Accurate GSTR-1 Filing is Important

Legal Safety and Compliance

Correct GSTR-1 filing helps follow government rules and reduces the risk of penalties or inspections from tax officers. It also keeps records clear and makes it easier to match data with what buyers report, ensuring there are no mismatches.

Easy Tax Credit

Buyers depend on GSTR-1 data to claim their input tax credit, so any mistakes or wrong entries can block their claims and lead to losses. Accurate and correct details ensure that both sellers and buyers receive the proper tax benefits without any issues.

Building Trust and Better Efficiency

Filing on time shows honesty and reliability to customers and partners, building trust and improving business relationships. Proper GSTR-1 filing keeps work organised, allowing the business to grow smoothly without concerns about rule violations or audits.

Common Filing Mistakes to Avoid

- Incorrect classification under B2B vs B2C categories can lead to data mismatches and communication issues with buyers.

- Missing or wrong HSN codes, especially after the 2025 amendments, may cause compliance errors or notices from the tax department.

- Forgetting to add shipping bill numbers in exports can result in incomplete export details and delays in processing claims.

- Late filing leads to penalties and ITC blockage, affecting cash flow and business operations.

Conclusion

Filing GSTR-1 is an important part of GST compliance, which needs proper attention, accuracy and timely action. With the new 2025 updates, businesses must be more careful while reporting HSN codes and invoice details.

Our GST software makes this process simple by automating data collection, reducing penalties, and building trust with customers and tax authorities.

Start using our software today to make your GSTR-1 filing fast, easy and fully accurate so you can focus more on growing your business.

No comments yet