All invoices are not the same

Many businesses and clients assume that all bills are invoices. But in reality, not all invoices are the same. There are a few formats of invoices that every business should use at different stages of the business billing process, which is tax invoice, the proforma invoice, and the receipt

Every business owner should maintain a structured invoicing flow. This helps keep records organised, ensures an accurate billing process, and prevents misunderstanding between the business owner and customers. A proper invoicing process makes your audit and filings always accurate.

Let’s understand the differences between a tax invoice, a proforma invoice, and a receipt, and how to keep invoicing flow with the help of Invocerto’s easy invoicing software. Invocreto follows a simple and practical process:

Order Or Proforma Invoice → Receipt → Final Tax Invoice → GSTR-1

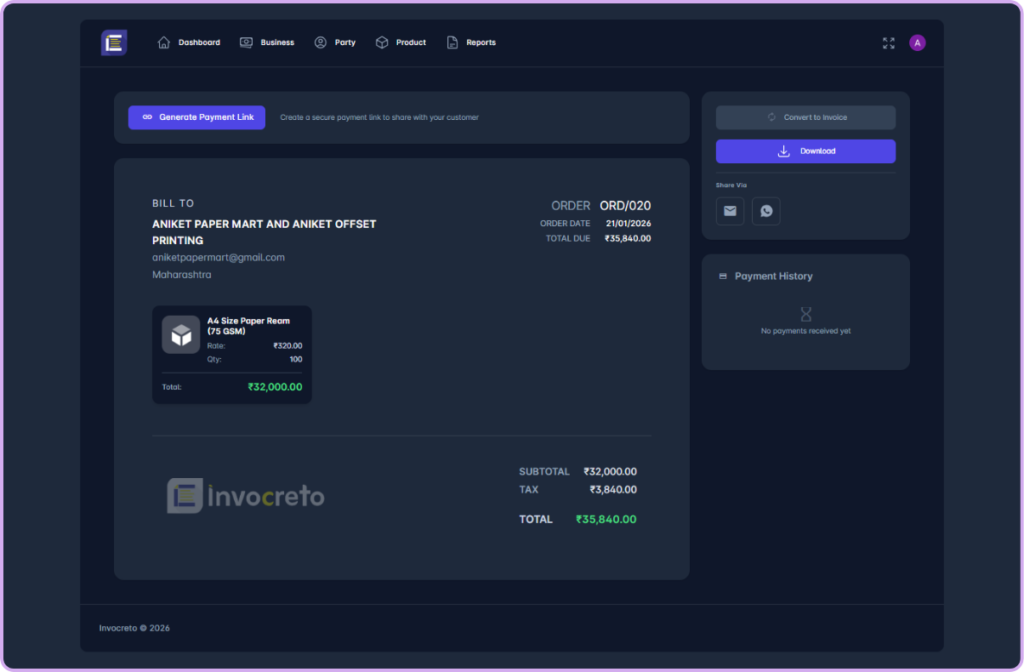

Order OR Proforma Invoice

Many people think billing starts only after payments, but in reality, billing starts earlier. An order or a proforma invoice is the first step of the billing process. It helps both seller and customer understand what is being sold and at what price before the final bill is created

What is a proforma invoice?

An order is created when the client confirms their requirement, but payments have not been made yet. A proforma invoice is a temporary invoice shared with customers before the actual sale happens. It shows the cost of the product or service

Live Example:

A client confirms:

- Digital marketing service – ₹15,000

You create an Order (Proforma Invoice) in Invocreto and share it with the client.

It includes:

- Business details

- Customers details

- Product or service details

- Order invoice number

- Issue date

- Quantity

- Price per unit

- Price breakup

- GST (for reference)

- Due date

The client reviews and approves it.

Why Order / Proforma Invoice Is Important:

- Clear price communication

It clearly shows the price of products or services in advance, so the customer knows the total cost before agreeing - Avoids misunderstandings

All details like quantity, price, taxes, and terms are written clearly. This helps avoid confusion or disputes later. - Customer approval before work starts

Businesses can get customer confirmation before starting work or delivering goods, which reduces risk - Look professional

Using proforma invoices shows professionalism and builds trust with customers

Note: This document does not affect GST filing and is not reported in GSTR-1.

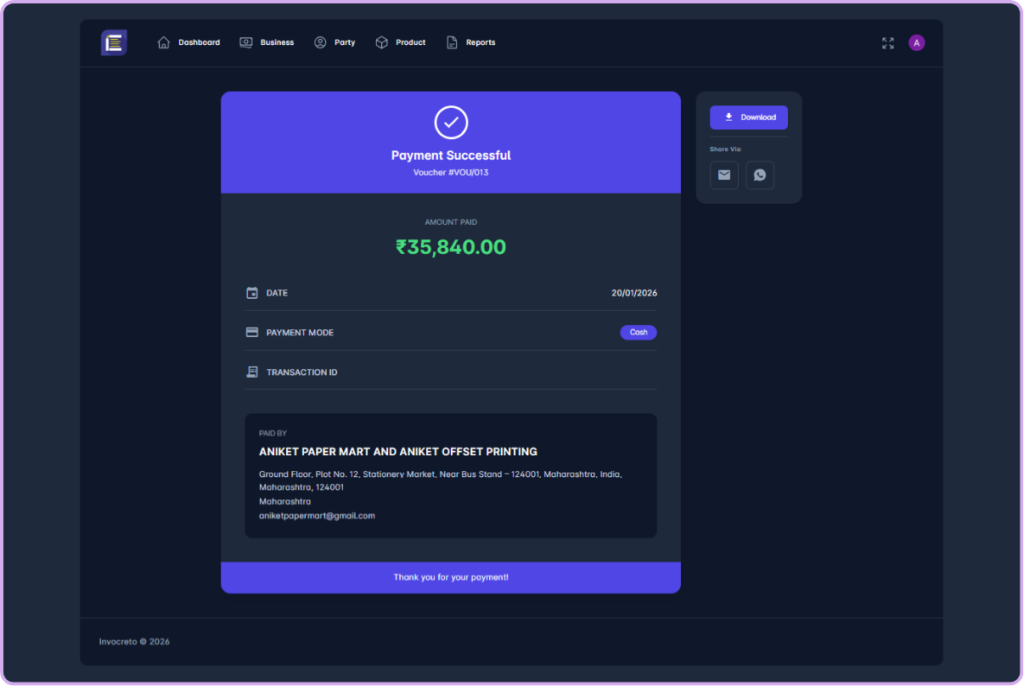

Receipt: Proof of Payment

A receipt is a document given to the customer after payment is received. It acts as proof that the customer has paid for goods or services. Receipt is 2nd step in the billing process and confirms that transaction is completed.

Receipt confirms that the business has received money from the customer. It can be issued for:

- Full payment

- Partial payment

- Advance payment

Once the client makes a payment, you generate a Receipt (or Voucher) in Invocreto.

Live Example:

The client pays ₹15,000 via bank transfer.

You issue a receipt mentioning:

- Amount received

- Payment mode

- Payment date

Benefits of Receipt:

- Acts as payment proof for the client

- Helps in internal accounting

- Improves transparency

- Useful for audits and records

- Builds customer trust

Note: Receipt is not a tax invoice and has no GST reporting impact.

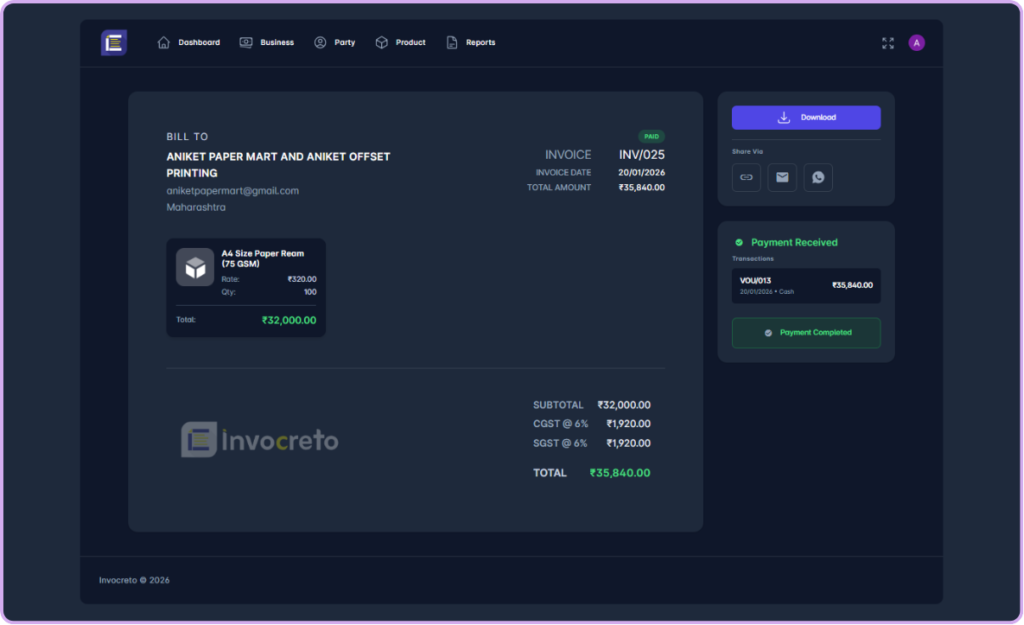

Final Tax Invoice: Generated After Full Payment

A final tax invoice is an official document issued by a business after goods or services are delivered and full payment is received. It is a legally valid document used for accounting, tax filings, and audit purposes. This invoice confirms that the sale is completed

The final tax invoice is the last and most important step in the billing process. It shows complete and confirmed details of the transaction, including tax details. Once an invoice is issued, it becomes part of the business’s official financial records. This invoice is used by both businesses and customers for tax and accounting purposes

After receiving full payment, Invocreto allows you to generate a Final Tax Invoice in one click from the same order.

Live Example:

Once payment is confirmed:

- Click “Generate Invoice”

- All order details are auto-filled

- The GST invoice number is created

This invoice:

- Is legally valid

- Goes for GSTR-1 reports

- It is used for GST compliance

Why Final Invoice Matters:

- Mandatory for GST filing

- Required for ITC claims

- Legal proof of sale

- Keeps your business compliant

With Invocreto, you don’t need to create documents again and again.

Order (Proforma) → Receipt → Tax Invoice – GSTR-1

Everything is connected and automated.

Key Benefits of This Flow:

- Saves time

- Reduces manual errors

- No duplicate data entry

- Clean and accurate GST invoice reports

Difference Between Order (Proforma), Receipt & Tax Invoice

Common Billing Mistakes Businesses Make

- Raising an invoice before payment

- Skipping receipt

- Manual GST errors

How Invocreto avoids these mistakes.

Who Should Use This Billing Flow?

This structured process works for businesses where payment transactions and confirmations happen.

Service-Based Businesses

Service providers like digital marketing agencies, consultants, IT services, and freelancers often need client approval before starting work. Creating an Order (Proforma Invoice) helps confirm pricing and scope, issuing a receipt confirms payment, and generating the final invoice ensures smooth GST filing.

Freelancers & Independent Professionals

Freelancers benefit from this flow because it avoids payment confusion. Sharing a proforma/order sets expectations, receipts act as payment proof, and the final invoice keeps income records clean and professional.

Small & Medium Businesses (SMEs)

SMEs handling multiple clients and payments can track everything easily with this billing flow. It reduces manual errors, improves cash flow visibility, and keeps GST invoice reports accurate.

Startups & Growing Businesses

Startups that want to look professional from day one can use this flow to build trust. Clear documentation helps during audits, funding discussions, and tax filings.

Businesses Requiring Advance or Full Payments

If your business collects advance or full payments before issuing an invoice, this flow is perfect. It ensures invoices are raised only after payment, keeping GST compliance in check.

Why Invocreto Is the Right Invoicing Software

Invocreto is built to make invoicing simple, accurate, and GST-compliant for Indian businesses. It follows a practical billing flow, how real businesses work, from order confirmation to final invoice generation.

GST-Ready Invoicing

Invocreto helps you create GST-compliant invoices with correct tax details. Final invoices are automatically included in GSTR-1 reports, reducing manual work and filing errors.

Simple & Easy-to-Use Interface

You don’t need accounting knowledge to use Invocreto. The interface is clean, user-friendly, and designed so that anyone can create orders, receipts, and invoices without confusion.

Order-to-Invoice Automation

Create an Order (Proforma Invoice), collect payment, and convert it into a final tax invoice in one click. No duplicate data entry, no rework, and no mistakes.

Built-In Compliance Support

Invocreto, make sure your billing follows proper GST rules. From document flow to reporting, everything is structured to keep your business audit-ready and compliant.

Conclusion: Simplicity and compliance

A clear and structured invoicing process is essential for every business, especially when it comes to invoicing for small businesses. Understanding differences between a proforma invoice, an order, a tax invoice, and a receipt helps avoid confusion, make accurate billing, and build trust with customers. When each document is used at the right stage, businesses can maintain clean records, reduce errors, and stay compliant with tax rules.

Invocreto simpllifies entire invoicing flow by offering GST-ready invoicing, an easy-to-use interface, and smooth order-to-invoices automation. With Invocreto, businesses can manage billing confidently, stay audit-ready, and focus on growing their business without worrying about invoicing.

No comments yet