Are you a service provider who is not getting paid on time? To receive payment on time, you need to provide an invoice to the customer, which acts as a reminder and proof of payment. Using invoicing software, you can customize your invoices according to your brand, business type. A professional invoice can impress your client, and you can get paid faster.

An invoice is a simple document that the seller gives to the buyer to ask for payment for goods or services. It lists what was sold, how much it costs, and when payment is due. The invoice also shows names and contact information for both seller and buyer, date and special invoice number for tracking. An invoice helps both sides keep track of what was bought, how much needs to be paid, and makes sure payments are made properly.

A well-designed, professional invoice can impress clients by showing your attention to detail, clarity, and care. This makes you look trustworthy, organized, and easy to work with. To create professional invoices, use our free invoice template and advanced invoicing software.

Important details about invoices that help get payment on time

- Clear payment terms that mention when payment is due, like ‘pay by this date’, ‘Due date’. This helps customers know when to pay and avoids confusion.

- Sending an invoice quickly after you deliver goods and services, so it’s a fresh bill for your service

- Offering different payment methods like bank transfer, credit card, or online payment, so it’s easy for customers

- Adding a unique invoice number, invoice date, clear list of what you sold helps understand the invoice easily.

- Mention if there will be any penalty for paying late or any discount for paying early. It will encourage customers to pay sooner.

- Create a neat, simple, professional invoice with no errors/mistakes

Ways to Invoice can impress clients

- Use clear and simple language, avoid using confusing terms, and keep everything easy to read.

- Create a clean layout with enough space between sections, add the company logo use brand color so it can match your brand and business type

- Include all information your client needs, like your provided services, amounts, dates any payment options

- Be polite and friendly, add a short thank you note at the end

Why professional invoices matter

Professional invoices are not just payment request. They are formal records for you and your client. Well-made invoices reduce the chances of mistakes and misunderstandings. Your client understands exactly what they are being charged for, why they need to pay, and how they should make payment.

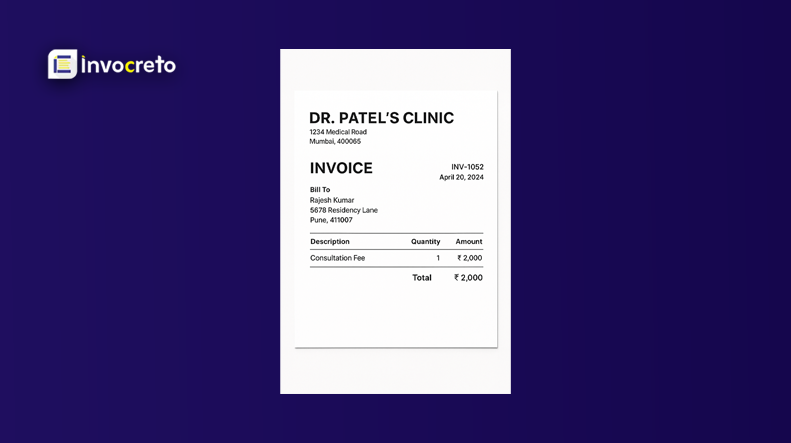

This is a real-life example of a poorly designed invoice. The doctor’s office sent an invoice with important information about an earlier payment discount and penalty for overpayment printed in very small blue text at the back of the page. Then the client misunderstood the actual amount due because of details were hard to find and read. And client paid more than required.

When the client realized the mistake and requested a refund, the clinic charged a ₹500 administration fee for processing the refund. The client felt confused and frustrated because the information was not clearly visible on the invoice. This is how unclear, hidden, or poorly organized invoice information can make payment errors and customers unhappy.

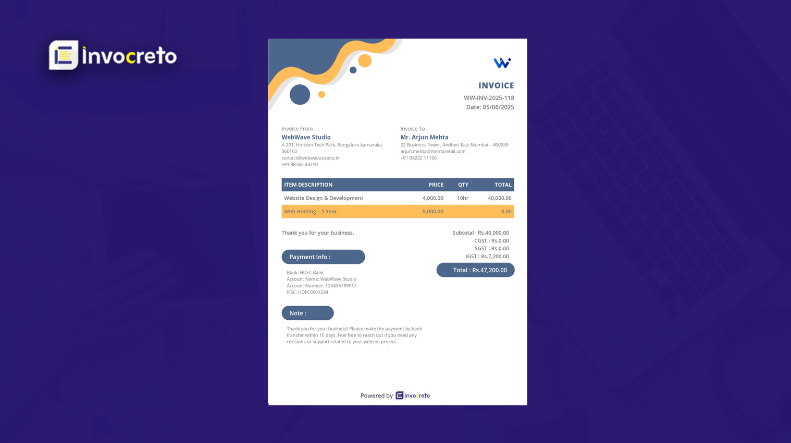

This is a professional invoice of a freelance web designer who sends a client invoice that has

- Their business name, address, and logo

- Client name and contact information

- Added invoice unique number and invoice date

- Clear itemized list: website design – 10 hours ₹4,000/hr and hosting 1 year ₹6,000

- Tax details, payment methods, and due date

- Notes like “ thank you for your business. Please pay by bank transfer within 15 days.”

This professional invoice helps the client to know quickly what they are paying for, how much, when to pay, and how to pay. Also design is simple and visually appealing, so there is no confusion, and payment is quick

Key elements to include in your invoice

To make sure your invoice helps you get paid on time, few details that should always be included.

- Your business information

– Business name: Your company name or personal name if you’re a freelancer.

– Address: Include your physical address

– Email Address: best way for clients to contact you

– Phone Number: Optional, but helpful if you need to follow up.

– Business Number or Tax ID: This may be necessary depending on your location or the type of work you do. - Client Information

– Client name: Name of person or company you’re billing.

– Client address: If your client is a business, add the business address.

– Clent contact info: Their email address and phone number can be helpful if you need to follow up. - Invoice number:

Each invoice should have a unique number. Important for:

– Tracking your invoices

– Keeping your financial records organized.

– Your client can easily reference the correct invoice

– You can use a simple numbering system like INV-001, INV-002, etc, or create a more complex system like 2025-001 to show year and invoice number. - Invoice date

This is the date when the invoice is created and sent. It’s important because it is the start of payment terms (e.g, “Due 30 days from invoice date”) - Due date

Clearly state when you expect payment. Common due dates are:

– Net 30: Payment is due 30 days from the invoice date.

– Net 15: Payment is due 15 days from the invoice date

– Due on receipt: payment is due immediately from receipt invoice

List of products/Services

This is the core of your invoice. Clearly list what you did or sold, along with:

– Description: short but clear description of services or goods you provided

– Quantity: If applicable, list how many items or hours of service you provided

– Unit Price: price per item or hour of service

– Total: total price for each item or service, based on quantity and unit price

For example:

| Description | Quantity | Unit Price | Total |

| Website design | 10 hours | ₹50/hour | ₹5000 |

| Logo design | 1 | ₹2000 | ₹2000 |

| Subtotal | ₹7000 |

- Payment terms and conditions

– Accepted payment methods: Specify how you want to be paid (bank transfer, PayPal, cheque, credit card, etc.)

– Late payment fee: If you plan to charge a late fee for overdue payments, state this upfront. For example, “50% late fee will be charged if payment is not received within 30 days.”

– Refund policy: If applicable, mention if refunds are possible and the conditions for issuing them - Taxes

If you’re required to charge taxes (sales tax or VAT,) make sure to include this on your invoice. Specify GST rate and amount for each taxable item. For example:

– Tax rate: 10%

– Tax amount: ₹70 (for subtotal of ₹700) - Total amount due

At the bottom of your invoice, clearly show the total amount due. This should include the cost of services or products, taxes, and any other fees. Make it easy for your client to see what they need to pay

For example:

– Subtotal ₹700

– Tax (10%) ₹70

– Total amount ₹700 - Your payment details

Finally, provide clear instructions for how your client can pay you. This includes:

– Bank account details (if you’re accepting wire transfers)

– PayPal account (if applicable)

– Payment link (if using any online invoicing software )

Steps to create perfect invoices

- Use a good tool

Use advanced invocreto invoicing software to create professional invoices

Invocreto invoice software includes features like easy customizations, automated calculations, and quick invoice sharing. - Personalizing your invoices

Add your logo, brand colour palette to match your business brand, and create your communication style to match clients’ preferences for a personal touch

‘Focus on key design principles: clear hierarchy, plenty of white space, simple fonts, and organized sections.’

- Review for accuracy

Double-check calculations, dates, and details to avoid errors. Also, check for missing or inconsistent information before sharing your invoices. - Send quickly

Share the invoice quickly after providing services or goods. Send invoice in the format that the client preferred: PDF, email, or online portal - Organized and Track

Organized your invoices by client and date. Keep a record of paid and unpaid invoices to follow up when needed.

Our invocreto invoicing software offers everything you need for creating professional invoices, from easy calculations to quick sharing, to make your invoicing process smooth every time. Customize your invoices by adding a logo, brand color, and business details. You can also choose our free invoice templates according to your business type. Register your business with GST register and make GST calculation easily with the help of our GST calculator and download your invoice in the client’s preferred format, or you can share invoices on the daily use platform email and WhatsApp. Keep track of or manage multiple clients paid or unpaid invoices to follow up when needed.

Invocreto has this all at one dashboard with more powerful features to simplify your invoicing process.

Why use online invoicing software for invoicing

Time-saving and automation: our invocreto Invoice software automates tasks like invoice creation, sending payment reminders, and tracking payments. This reduces manual paperwork and human errors, letting you focus on running your business.

Professional look: You can customize invoices with your company logo, brand colors, and templates, helping you look more trustworthy and professional to your clients. invoicing software

Improve accuracy: Automated calculations for totals and tax results in fewer mistakes, helping to smooth transactions and better relationships with customers.

Faster payment and better cash flow: Invoicing software sends payment reminders, offers easy online payment options, and helps customers pay quickly.

Easy tracking and organization: Invoicing software allows you to organize, manage, search, and recover records instantly, which makes it easy to follow up on unpaid invoices

Security and compliance: Online invoicing software uses advanced security that keeps your data safe and organized

Creating invoices that help you get paid on time doesn’t have to be complicated. Use our free invoice template and create invoices in minutes. By including all necessary details and keeping your invoicing process organized, you can make sure that clients know exactly what they need to pay and when they need to pay you. Professional, timely invoices not only help you get paid faster, but they also reflect positively on your business and show your client that you take your work seriously.

By following the tips outlined in this guide and by using our online invoicing software, you’ll be able to build a smooth and effective invoicing process that helps you maintain healthy cash flow.

Remember: Simple and clear invoices lead to getting paid on time.

No comments yet