Managing invoicing and GST is an important part of running any business in India. Many small and growing businesses often handle this work with different tools. One tool might be for invoicing, another for GST filing, and sometimes a separate system tracks payments. While this setup may seem manageable at first, it creates problems as the business grows.

Using a single platform for invoicing and GST filing helps businesses save time, reduce errors, and stay compliant without stress. This blog explains the common problems of using multiple tools and how integrated invoicing software like Invocreto makes business work simple and organised.

Problem with Using Multiple Tools for Invoicing and GST

Many businesses use different platforms for billing and GST tasks. One system is used to create invoices, another calculates tax, and GST reports are managed in a different location. This creates confusion in daily operations.

Common problems businesses face include:

- Different tools for invoicing and GST create confusion in daily work

- Switching between platforms wastes time and breaks workflow

- Invoice and GST data often do not match

- Manual data entry increases errors and effort

- Tracking payments and tax details becomes difficult

Using multiple tools may look useful at first, especially for small businesses. However, over time, it complicates work. Important data gets spread across systems. Even a small mistake in one tool can lead to bigger compliance issues later. A simple and connected process is necessary to manage invoices and GST smoothly.

Confusion, Errors, Data Mismatch, and Manual Work

When invoicing and GST systems are not connected, businesses spend more time fixing mistakes than focusing on growth. Data is entered multiple times, checked again and again, and still may not match during GST filing.

Invoice values, tax amounts, and customer details often differ between tools. This creates confusion during monthly or quarterly GST filing. Business owners have to manually compare reports, correct errors, and rework invoices.

This scattered approach leads to:

- Higher chances of human errors

- Delays in GST filing

- Extra manual effort

- Stress during compliance deadlines

A simple and connected approach helps reduce manual work and keeps business records accurate and updated.

Why a Single Integrated Platform is the Better Choice

A single platform that combines invoicing, GST calculation, and reports can make business operations easier. Instead of using multiple tools, everything functions together in one system.

With integrated invoicing software, data flows easily from invoices to GST reports. There is no need to re-enter information or worry about mismatched numbers. Invocreto helps businesses handle invoicing and GST from one simple platform. This allows business owners to focus more on growth and less on paperwork.

Benefits of using one integrated solution:

- One place for invoices and GST

- Less manual work

- Fewer errors and mismatches

- Faster and stress-free compliance

“One Platform” Mean?

When all business tasks are managed together, businesses stay organised and save time. Using one platform means handling all billing and GST-related tasks in a single system. It removes the need to use separate tools for different tasks and creates a smooth workflow.

One platform includes:

- Invoicing

- Automatic GST calculation

- GST reports

- GST return-ready data

All Invoicing and GST Work in One System

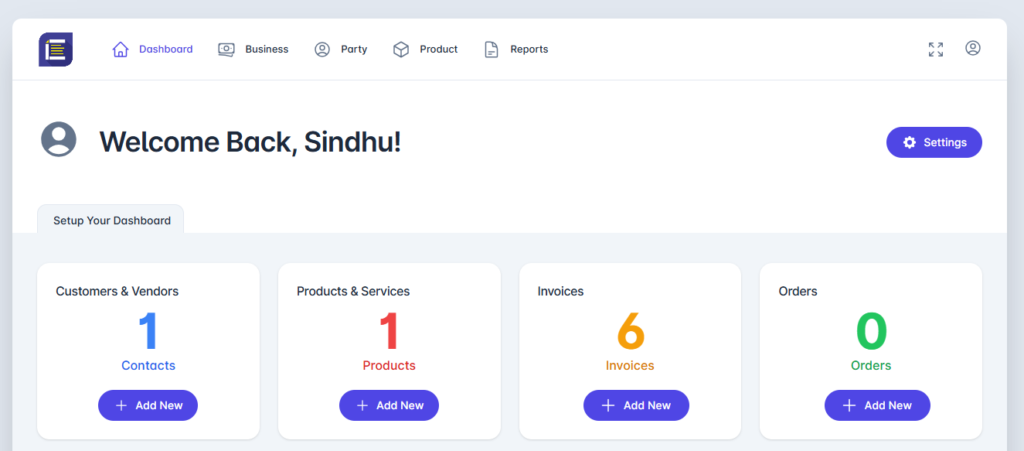

One platform means managing invoicing, GST calculation, reports, and GST-ready data in one system. Instead of switching between platforms, everything is available in one dashboard. This helps businesses manage billing and GST filing smoothly without confusion or extra effort.

Invocreto combines:

- Invoicing

- GST calculation

- Payment management

- GSTR-1 reports

How Invocreto Brings Everything Together

Invocreto is designed to simplify daily business work by connecting all important tasks. From creating invoices to preparing GST data, everything happens automatically within the system.

With Invocreto, businesses can:

- Create GST-ready invoices

- Get automatic GST calculation

- Generate GST reports easily

- Access data that is ready for GST returns

This saves time and avoids confusion caused by using separate tools. As a GST invoice software, Invocreto ensures that tax values are accurate and updated across all reports.

Key Benefits of Using One Platform

Using a single platform reduces manual work and improves accuracy. Tax is calculated automatically with the correct GST breakup, including CGST, SGST, and IGST.

There is no need to calculate tax manually or worry about manual mistakes. This helps reduce human errors and ensures that reports are accurate and ready for GST filing.

Invocreto also makes GST reporting simple by providing easy-to-use reports, such as:

- GSTR-1

Faster invoice generation, auto-filled details, and ready reports help businesses focus more on growth and less on compliance work. This makes Invocreto a reliable billing software for small business owners.

Faster Invoice Generation with Less Effort

Creating invoices manually can take a lot of time, especially when GST details need to be added carefully. With Invocreto, invoices are created quickly and are GST-ready, sent on time, and maintain a professional image with customers.

- Faster invoice creation

- Automatic GST calculation

- Clean and professional invoice format

Smooth GST Filing Process & Compliance

GST filing can be stressful when data is spread across different tools. Missing details, last-minute corrections, and often slow down the filing process and raise the risk of errors

With a connected system like Invocreto, GST data stays organised and updated in one place. Invoices, tax values, and reports are automatically prepared in the right format.

This makes it easier to:

- Review GST data

- Match invoice and tax details

- File returns on time

Having return-ready data and clear GST reports helps businesses stay compliant without confusion. The GST filing process becomes smoother, faster, and more reliable.

Staying Prepared for GST Compliance Notices

Incorrect or delayed GST filing can sometimes lead to compliance issues. Businesses may receive a GST compliance notice due to data mismatch, missing returns, or reporting errors.

Using proper GST invoice software helps reduce such risks by keeping records accurate and organised. Businesses can stay better prepared for GST compliance requirements and avoid unnecessary penalties or follow-ups.

Why Invocreto Works Well for Small Businesses

Small businesses often do not have dedicated accounting teams. They need a system that is simple, reliable, and easy to use.

Invocreto is built for Indian businesses. It supports daily billing needs while also helping with long-term compliance and growth.

As a billing software for small business, Invocreto helps owners manage invoices and GST without needing technical knowledge.

Final Thoughts: Why Invocreto Is the Right Choice

Invocreto brings invoicing and GST management together in one simple platform. It is designed for Indian and small businesses that want an easier way to manage daily billing without confusion.

With a clean and simple interface, Invoice Generator, Invocreto helps automate routine tasks while supporting long-term business growth. Reducing manual work and improving accuracy, it allows business owners to focus more on customers and less on paperwork.

Why businesses choose Invocreto:

- One platform for invoicing and GST

- Simple and easy-to-use interface

- Designed for Indian business needs

- Built to support professionalism and growth

Example:

A small service business creating invoices manually often spends hours checking GST values and preparing reports. With Invocreto, invoices are created with automatic GST calculation, and reports are ready for GST filing. This saves time, reduces errors, and makes monthly compliance stress-free.

Important Note:

Using separate tools may work at the start, but as a business grows, it leads to confusion and compliance risks. Choosing a single, reliable platform like Invocreto early helps build a strong, organised, and scalable billing system for the future.

No comments yet