Every year, people look at budget for tax changes, new schemes and government spending plans. The Union budget 2026-27 in India is important because it shapes how individuals and businesses will report income, pay tax and manage records for year ahead. In this year’s budget not big tax slab changes, but it confirmed implementation of New Income Tax Act 2025 for better invoicing and digital tax compliance.

If you run company, work independently, or manage small business, this guide will help you understand changes so you can keep clean records and clear compliance

Why Union Budget 2026-27 important for you

Every year, Union Budget sets rules. Even if you run small business, work as freelancer or are self-employed these rules affect your tax bill, compliance requirements and financial planning:

- How much tax you pay

- What you must report

- How income and profits are recorded

- When returns must be filed

Income Tax slabs for FY 2026-27 (AY 2027-28)

For most individuals and small businesses that file tax returns under individual or HUF status, new tax regime continues with same slab structure that was introduced in earlier income tax reforms.

New Tax Regime slabs (simple and uniform)

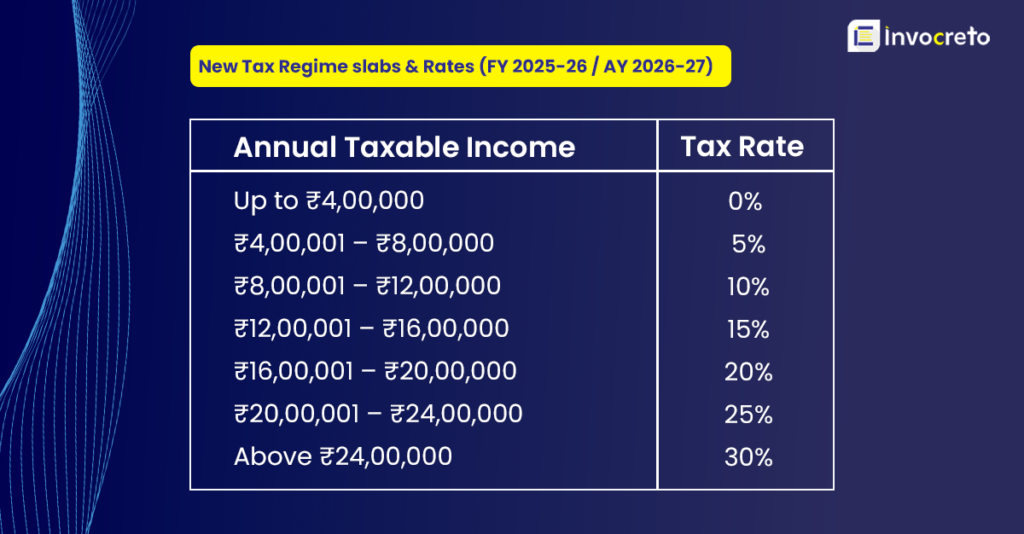

Under new tax regime, following slabs apply for FY 2026-27. This slab structure is same across all individuals, no different age-based like earlier.

Income up to ₹12 lakh is effectively tax-free under new regime for most taxpayers. After rebate, tax payable becomes zero if total income is below ₹12 lakh.

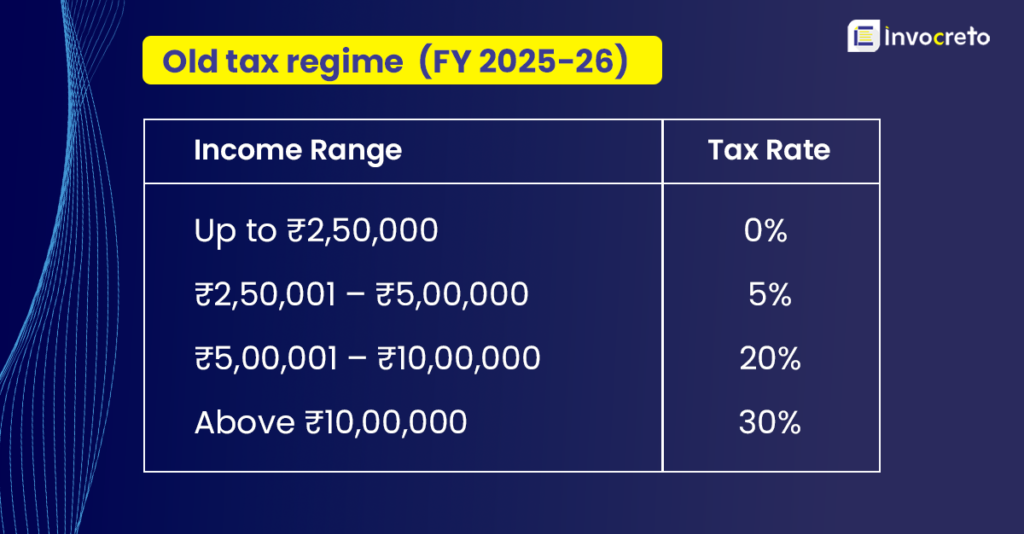

Old tax regime is still available

You can still choose old tax regime if it benefits you (for example, if you have many deductions like home loan interest).

New Income Tax Act 2025

The new Act will be effective from April 1, 2026, for financial year 2026-27 onwards. This is brand new tax law replacing old Income Tax Act of 1961 (which was there for decades).

The new Income Tax Act 2025 is meant to make rules clearer, easier to understand, less confusing, more digital-friendly. It tries to reduce olf complex language and overlapping clauses that existed in older law.

Why invoicing matters more now

Under updated tax system, invoices are no longer just bills; they are proof of income and tax compliance. To be fully compliant with tax and accounting requirements, an invoice should include:

- Buyer’s details

- Your name or business name

- Date of invoice

- Unique invoice number

- Description of goods/services

- Amount charged

- Tax details (GST if applicable)

This is important because tax authorities now match invoice data digitally with income you report. Now government is pushing businesses and professionals to use digital invoicing system so that records are safer, errors are fewer, tax returns are easier and more accurate. Manually creating multiple invoices is not possible and it can lead to errors, small mistakes so using invocreto invoicing software is smart move in 2026.

What these tax changes mean for businesses

Small businesses & MSMEs

- Income reporting must be accurate, poor invoices can lead to questioning of income

- Tax planning becomes easier, because slab structure is stable for next year

- Choosing old vs new regime depends on your deductions and expenses

Even if taxes stayed similar, invoices and records must be accurate or you may face tax notices. Digital invoicing helps reduce errors and speeds returns.

What Freelancers Should Focus On

1. Issue an Invoice for Every Payment

If you work as freelancer and want to reduce mistakes while filing ITR, every payment you receive should have a proper invoice with:

- Details of service

- Amount received

- Date and invoice number

Previously, taxpayers could file revised returns only up to 31 December of assessment year. Union Budget 2026 extends this revised return filing timeline to 31 March of the assessment year (e.g., for AY 2026-27).

Revised returns filed after 31 Dec but before 31 Mar will require payment of a nominal fee (e.g., ₹1,000 or ₹5,000 based on income level) under the new rules.

2. Keep Digital Evidence

Use digital tools (use invoicing software) to:

- Store invoices

- Track payments

- Show bank records

3. Understand Tax Slabs

If your income after expenses is below ₹12 lakh a year, tax under the new regime may be zero after rebate. But if you earn more, knowing the slab helps in planning ahead.

Important Dates & Compliance Tips

Although Budget 2026 didn’t change all dates, keeping track of filing deadlines is important:

- (AY 2026-27): 31 July 2026 for most taxpayers.

- Timelines for returns may change with the new law, but typically:

- 31 July: Individuals and HUFs

- 30 September: Audit-required businesses (if applicable)

Final Thoughts

The Union Budget 2026-27 focused on clarity, stability and digital compliance. While it kept tax slabs similar, it also made New Income Tax Act 2025 ready for launch and encouraged better invoicing and record keeping.

For freelancers, MSMEs and small businness owner this means:

- Stable tax rates to plan finances

- Clear rules for income reporting

- Choice between old and new tax systems

If you stay organized with invocreto invoicing software and understand slab structure, you can reduce confusion and focus on growing your business or work without worrying about last-minute tax surprises.

No comments yet